IT IS YOUR MONEY

Renewable Energy Projects Go On-Chain

Renewable energy projects are now being tokenized, enabling transparent, fractional investment in solar farms, wind turbines, and green hydrogen facilities. Blockchain ensures traceability of energy production and automated distribution of returns. From Europe to Southeast Asia, governments and startups are leveraging digital assets to accelerate the clean energy transition. This innovation lowers capital barriers and aligns investor returns with environmental impact.

Standard Chartered forecasts surge tokenizing RWA

Standard Chartered projected that tokenization of real-world assets (RWAs) beyond stablecoins could accelerate significantly over the next five years, driven by regulatory progress and a sharper focus on high-impact use cases, according to a June 20 report shared with CryptoSlate. The bank’s report, titled “RWA Tokenisation — A Growth Opportunity,” highlighted that while stablecoins remain the dominant driver of blockchain-based RWAs

Multi-currency Stablecoins and RWA Tokenization

Synagistics Limited (HKEX: 2562), Southeast Asia's leading AI-powered digital commerce platform, today announced the launch of Synagistics Digital Finance Group (SDFG), a strategic initiative aimed at building interoperable, multi-currency stablecoins and real-world asset tokenization solutions to power Asia's digital finance infrastructure. This milestone marks Synagistics' official entry into the programmable finance sector

Agriculture Gets a Digital Makeover with Tokenization

Agriculture is embracing tokenization to improve financing, traceability, and investor access. Farms, harvests, and equipment are being turned into digital assets. Blockchain ensures transparency from soil to shelf. Projects in Africa and Latin America show how farmers and investors benefit from this innovation.

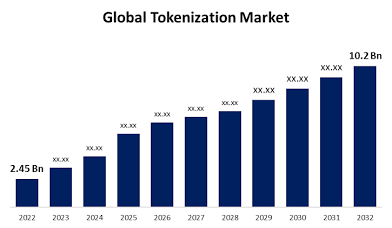

Tokenized Finance Enters its Breakout Era

Home » Blockchain » Wall Street Moves Onchain: Tokenized Finance Enters its Breakout Era Wall Street Moves Onchain: Tokenized Finance Enters its Breakout Era 25.07.2025 18:32 2 min. read Kosta Gushterov SHARE: 0 SHARES The tokenization of real-world assets (RWAs) has entered a new phase in 2025—no longer a concept, but a confirmed trajectory. According to Pantera Capital’s latest report, The Great Onchain Migration, over $24 billion in RWAs are now deployed on public blockchains, mo

Global Asset Tokenization Soars

In a jaw-dropping move that’s sending tremors across the crypto industry, Ledger has launched its $6 $XRP release offer, unlocking a tidal wave of investor interest and triggering a 2,260% explosion in global asset tokenization activity. This bold initiative, rolled out earlier today, is part of Ledger’s aggressive push to accelerate real-world asset (RWA) tokenization and expand XRP’s role as a settlement asset across digital and traditional finance.

Tokenized Infrastructure: Investing in Bridges & Roads

Tokenized infrastructure allows investors to own shares in public assets like bridges, roads, and utilities. Blockchain enables transparent, income-generating investments in essential services. Projects in Europe and Asia show strong institutional interest. This model offers stable yields while modernizing public financing.

Crypto heavyweights ramp up push for tokenization

Tokenization is going to open the door to a massive trading revolution," said Vlad Tenev, the CEO of the trading platform Robinhood at a recent James Bond-themed tokenization launch event in the south of France. Advocates say tokenization is the next leap forward in crypto and can help break down walls that have advantaged the wealthy and make trading cheaper, more transparent and more accessible for everyday investors.

How Institutional Investors Are Entering Tokenized Real Estate: Models, Motives, and Regulation

Real estate tokenization has moved from pilot to practice. Large, regulated investors are now testing, allocating, and in some cases building the rails themselves. The timing is not random. Clearer rules, better custody, permissioned infrastructures, and live secondary markets are arriving together. For institutions, the appeal is practical: finer liquidity, lower minimum tickets

Securitizing Art: NFTs and Tokenized Collectibles

Art is being transformed through tokenization, enabling fractional ownership and transparent provenance via NFTs. High-value collectibles, from paintings to rare watches, are now accessible to a broader investor base. Blockchain ensures authenticity and automates royalty payments. Platforms like Masterworks and Arianee are leading this digital renaissance in the art world.

Giants Protocol Powers Tokenization of Real Estate

Giants Protocol, a pioneer in AI-powered real-world asset (RWA) tokenization, has announced a landmark collaboration with Singapore-based co-living operator The Assembly Place (TAP) to tokenize real estate assets. This strategic move showcases the protocol’s ability to transform physical infrastructure into on-chain, yield-generating opportunities. The announcement marks a key milestone in Giants’ journey

Binance Launches RWUSD in Major RWA Tokenization Push

In its message to Binancians, the exchange introduced the new RWUSD product from Binance Earn. It is designed to deliver a reward of up to 4.2% APR to users based on their RWUSD holdings. Users can invest up to $5 million and still receive the same flat APR. This makes it easier for high-value investors to earn steady returns without rate drops.

Fractional Ownership via Asset Tokenization

Fractional ownership through tokenization allows investors to own a piece of high-value assets like real estate, art, or yachts. Blockchain enables secure, divisible, and tradable digital shares. This model lowers entry barriers and increases market liquidity. Platforms like Masterworks and RealT are already making luxury assets accessible to the masses.

MUFG, Japan’s largest bank to tokenize real estate for retail investors

Mitsubishi UFJ Trust and Banking, the trust division of MUFG, has acquired a high rise in Osaka City for more than Yen 100 billion ($681 million). It intends to use it to create digital securities and sell tokenized real estate to both retail and institutional investors, the Nikkei reported. On the institutional front, it will be sold to life insurers as a private real estate investment trust (REIT).

Robinhood crypto revenue doubles as CEO bets big on asset tokenization

Trading platform Robinhood’s crypto revenue increased 98% year-on-year to $160 million in the second quarter as CEO Vlad Tenev doubled down on plans to lead the real-world asset tokenization market in the US and abroad. Total net revenue climbed 45% year-on-year to $989 million, while net income increased by 105% to $386 million, Robinhood said in its earnings statement on Wednesday.

Digital Twins: Bridging Physical (RWA) and Digital Assets

Digital twins—virtual replicas of physical assets—are revolutionizing how we monitor, manage, and tokenize real-world objects. From factories to wind turbines, these models enable real-time data tracking and predictive analytics. When combined with blockchain, digital twins enhance transparency and trust in asset ownership and performance.

MUFG Bank Leads Osaka Real Estate Tokenization Drive

Japan’s financial powerhouse, MUFG Bank, has embarked on a landmark project to tokenize a high-rise commercial building in Osaka, signaling its growing focus on digital asset innovation. The initiative, developed in collaboration with real estate firm Kenedix and blockchain infrastructure provider Progmat, represents a major move toward integrating tokenized real estate into the country’s financial landscape.

Tokenization Boom Expected Following GENIUS Act Passage

Tokenization News: Real-world asset tokenization is set for explosive growth after the GENIUS Act became law, says Aptos Labs executive Solomon Tesfaye. The legislation establishes regulatory framework for the 260 billion stablecoin market, boosting institutional confidence. Private credit currently dominates 60% of the 24 billion RWA market, with tokenized U.S. Treasuries comprising 28%.

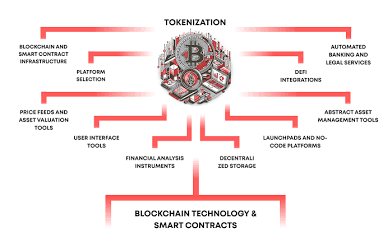

Real-World Assets Meet Decentralized Finance

Real-world assets (RWAs) are now powering decentralized finance (DeFi), bridging traditional value with blockchain efficiency. From tokenized bonds to real estate-backed loans, this fusion enhances yield opportunities and stability. Platforms like Maple Finance and Centrifuge lead the charge, enabling secure, transparent lending. This convergence marks a pivotal shift in digital finance.

How to become the world's leading digital asset center?

After a series of favorable policies for the development of digital assets were successively announced, how to gradually improve the infrastructure and product ecosystem has become an issue facing Hong Kong. "The (industry) attention is very high, especially after the Hong Kong government issued the declaration. I used to use up one box of business cards a year, but now I can distribute three boxes in a month.

© 2026