IT IS YOUR MONEY

Tokenized Precious Metals: Gold on the Chain

Tokenized precious metals are bringing gold, silver, and platinum onto blockchain networks, enabling fractional ownership, 24/7 trading, and instant settlement. Each digital token represents physical metal stored in secure vaults, combining tangible value with digital efficiency. Platforms like Tether Gold, Paxos, and Citi’s Digital Assets Group are leading adoption. This innovation is modernizing one of humanity’s oldest stores of value.

SBI Holdings, Startale announce RWA tokenized trading platform

Japan’s most prolific blockchain investor SBI Holdings has formed a strategic joint venture with Singapore-based Startale Group to develop a 24/7 onchain trading platform for tokenized stocks and real world assets (RWA). The partnership brings together SBI’s extensive financial infrastructure, including over 11 trillion JPY in assets under management and 65 million customers, with Startale’s blockchain technology expertise.

How Enterprises Can Leverage Real World Asset Tokenization

In recent years, enterprises across industries have been exploring blockchain technology not just as a buzzword but as a practical tool to unlock new opportunities. Among the most significant innovations to emerge from this space is Real World Asset (RWA) tokenization. The idea of converting tangible assets such as real estate, commodities, intellectual property, and even luxury collectibles into digital tokens on a blockchain is no longer experimental

Where Tokenization, DeFi and Legacy Finance meet: *DINGO CAPITAL* A New Era of Financial Services

For too long, "financial services" meant exclusion. Different apps, different cards, different rules for different people. They built walls. They created complexity. They left billions behind. The old financial system works for them, not for you. That ends September 16, 2025. Dingo Capital unifies every essential financial service under one roof. We're where the future of finance (Digital Assets, RWA, Tokenization & DeFi) shakes hands with the Legacy Banking & Insurance Services.

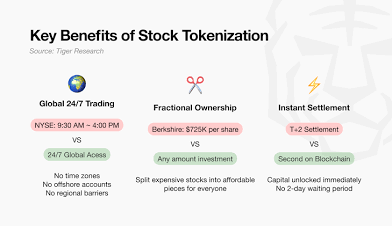

Kraken, Backed expand tokenized stocks to Tron ecosystem amid RWA push

On Wednesday, cryptocurrency exchange Kraken and tokenization platform Backed Finance announced an expansion of xStocks, a tokenized stock product offering, to the Tron blockchain. The move comes as real-world asset (RWA) tokenization, particularly within stocks, is taking hold. According to the announcement, Backed will deploy the stocks as TRC-20 tokens. Previously, Kraken and Backed launched xStocks on Solana and BNB Chain.

Stablecoins, and RWA Tokenization

Speaking at the Wyoming Blockchain Symposium on Wednesday, central bank Governor Christopher Waller said, “the payment system is experiencing what I have called a ‘technology-driven revolution’.” He added that this includes instant payments, digital wallets, mobile payment apps, stablecoins, and other digital assets, and AI. He specifically cited stablecoins, or fiat-pegged crypto assets, as the driver of this fintech revolution.

ROI upto 300%: No money No problem - No YEM No Problem. SDAM Club accepts (YEM Your Everyday Money)

DeFi (Decentralized Finance) revolutionizes traditional finance by offering open permissionless financial services powered by blockchain. SDAM.Club accepts YEM (Your Everyday Money) a stable and secure digital currency as the main input Asset that you can use to receive ROIs. SDAM's DeFi enables instant, low-cost global transactions without intermediaries. Thus, by accepting YEM it's combining the stability of fiat with the efficiency of crypto, making it ideal for world financial inclusivity.

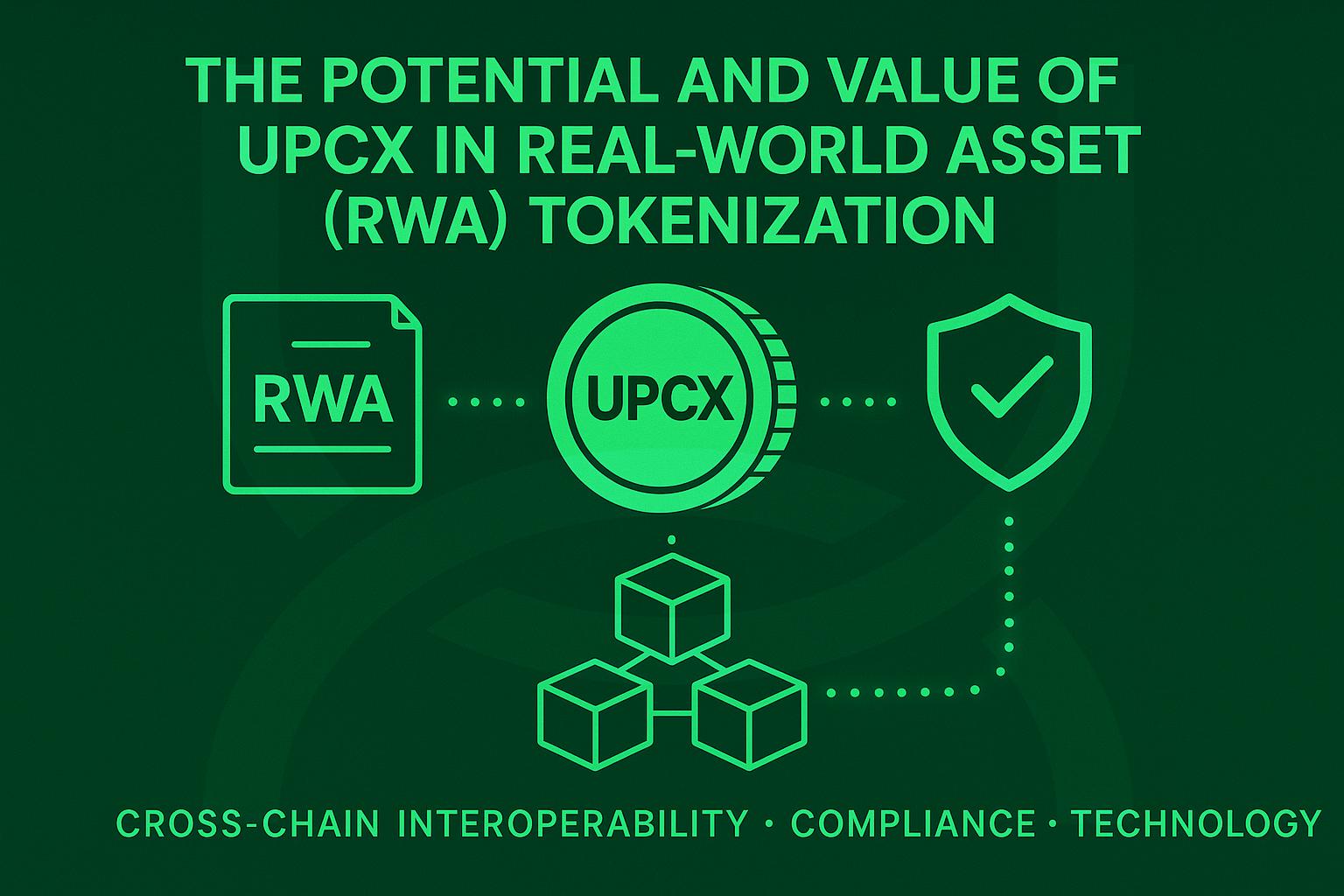

RWA Protocols Chase Volume While Ignoring the Architecture That Unlocks It

The tokenization of real-world assets (RWA) through blockchain technology, converting assets such as real estate, bonds, commodities, and artworks into digital tokens, is reshaping asset liquidity and accessibility. According to projections by Boston Consulting Group and Roland Berger, the RWA tokenization market could reach $10–30 trillion by 2030. This space has attracted blockchain platforms like Chainlink

RWA Tokenization Could Reshape LATAM Markets

Latin America is not simply adopting digital assets. It is setting the pace.” - A new report suggests that tokenizing real-world assets (RWA) could help resolve structural inefficiencies in Latin American capital markets and accelerate investment flows. Bitfinex Securities El Salvador’s Latin America Market Inclusion Report, released on August 20, said RWA tokenization can cut issuance costs for capital raises by up to 4% and reduce listing times by as much as 90 days.

Unlocking Trillions: Tokenizing Assets and the roll of DigitalWallet.center

The financial world is on a fast seismic shift, moving from paper-based deeds and complex ledgers to digital tokens on a blockchain. The tokenization of real-world assets (RWA)—from securities and real estate to art and commodities—is poised to revolutionize liquidity, accessibility, and efficiency in global markets. At the heart of this transformation lies one indispensable tool: the secure, self-sovereign DigitalWallet.center This is not just a technological upgrade; it's a must have tool.

Japan's SBI Holdings Joins Tokenized Stock Push

The step puts SBI alongside a growing roster of major players experimenting with tokenized stocks. Robinhood and several crypto exchanges including Kraken, Gemini started offering blockchain-based versions of publicly traded shares. SBI, which oversees more than 11 trillion yen ($74 billion) in assets and has over 65 million customers globally, sees asset tokenization as a major shift in global markets.

What Is RWA Tokenization, and How Does It Work?

Real World Assets are traditional properties with significant financial value. They include assets such as valuable commodities, real estate, precious metals (gold, silver, etc.), investment products (like treasury bills, shares, and bonds), fiat currencies, priceable artworks, and more. In a nutshell, they are tradable, financially relevant possessions whose value can be digitized.

Blockchain for Transparent Supply Chains

Blockchain is enhancing supply chain transparency by providing immutable, real-time tracking of goods from origin to consumer. Industries like food, pharmaceuticals, and luxury goods use distributed ledgers to verify authenticity, prevent fraud, and ensure ethical sourcing. Walmart, Maersk, and IBM Food Trust are leading implementations that improve efficiency and consumer trust across global networks.

Tokenized assets near $300 billion as Wall Street quietly floods on chain

The growth of tokenized U.S. Treasuries has emerged as a defining feature of this market. The segment surpassed $5 billion in March and now measures close to $7.3 billion in outstanding value. BlackRock’s BUIDL fund represents the largest share, with roughly $2.4 billion, followed by Franklin Templeton’s BENJI, at about $700 million, while Ondo’s OUSG and other vehicles, including USYC, JTRSY, and USTB, round out the leading issuers.

RWA Tokenization Services for Modern Businesses

In recent years, Real-World Asset (RWA) tokenization has emerged as a transformative force in the global economy. By converting tangible assets such as real estate, commodities, fine art, or even intellectual property into blockchain-based tokens, businesses are unlocking new levels of efficiency, transparency, and accessibility. What once required lengthy paperwork, intermediaries, and geographic proximity can now be achieved in a fraction of the time,

Tokenized Equity: Shares Without Intermediaries

Tokenized equity is redefining company ownership by issuing shares as digital tokens on blockchain, eliminating layers of intermediaries like transfer agents and clearinghouses. Startups and private firms use this model for faster cap table management and global investor access. Platforms like Tokeny and Polymath enable compliant issuance, signaling a shift in how equity is issued and managed.

Stellar Invests in UK-Based Archax to Expand Participation in the Tokenized RWA Space

Tokienization of real-world assets (RWA) is a business that is getting bigger, already moving billions in assets each year. The Stellar Development Foundation (SDF), the institution tasked with fostering adoption of the Stellar network, has announced a strategic partnership with Archax, the first crypto exchange regulated by the Financial Conduct Authority (FCA) in the UK. In a press release, Archax reported that the partnership encompassed an investment

Avalanche Gains Ground as a Hub for Stablecoins and RWA Tokenization

As reported by BeInCrypto, Wyoming officially launched the first state-issued stablecoin in the US. Notably, this stablecoin chose Avalanche (AVAX) as its deployment infrastructure instead of Ethereum (ETH). Beyond the US, Avalanche has also made its mark in Japan, where a yen-pegged stablecoin has received regulatory approval and is preparing to launch on the network. The rise of stablecoins on AVAX shows that the blockchain steadily earns institutional recognition.

Regulatory Sandboxes Foster RWA Innovation

Regulatory sandboxes are enabling safe experimentation with tokenized real-world assets by allowing startups and金融机构 to test innovations under relaxed rules. Jurisdictions like the UK, Singapore, and Switzerland host these controlled environments to balance innovation and investor protection. These programs are accelerating the adoption of digital securities, DeFi lending, and blockchain-based finance.

Real-World Asset Tokenization Firm Figure to Go Public on Nasdaq Under Ticker 'FIGR'

Blockchain-native capital marketplace Figure has filed a registration statement with the Securities and Exchange Commission for an initial public offering (IPO) on Nasdaq under the ticker symbol FIGR. The company is offering shares of its Class A common stock, with the initial public offering price yet to be determined. Figure will have two classes of common stock, with Class A shares carrying one vote per share and Class B shares carrying ten votes per share,

© 2026