IT IS YOUR MONEY

RWA Tokenization: Preview Of A Bubble Or The Next Big Thing?

LSEG’s new Digital Markets Infrastructure (DMI) platform takes private funds (a form of RWA: they’re not crypto-native, but traditional investment funds) and puts their entire lifecycle — from issuance to settlement — onto distributed ledger technology (DLT). This is tokenization in action as private fund shares can be digitally represented, making them easier to distribute and trade among investors.

RWA Watch: Key Players, Projects and Updates in Real World Asset Tokenization

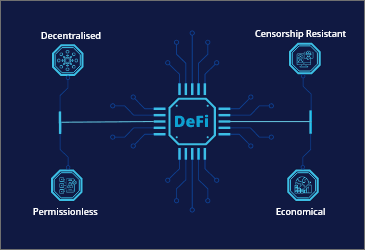

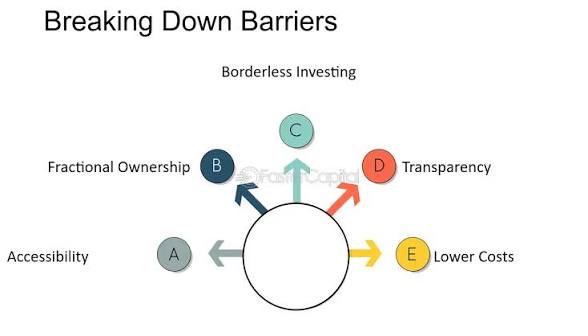

Real-world asset (RWA) tokenization refers to the process of representing tangible or regulated financial assets, such as real estate, money-market funds, private credit, or government bonds, on blockchain networks. It provides fractional ownership, enhanced liquidity, and programmable compliance, enabling institutions and individual investors to hold, trade, or use these assets in decentralized finance (DeFi) environments. Tokenization bridges traditional finance and blockchain

Dingo Capital is Launching: Is Legacy Finance Obsolete?

Dingo Capital is not just another app. It's a single, powerful hub for your entire financial life: Digital Wallets, Investments, Loans, Insurance, and more. All designed with one core mission: to put financial power back where it belongs. With you!!! Are you ready to be part of this Financial Revolution? Join the Dingo Capital's Kick-off Celebration on September 30, 2025. Be the first to know when FREE accounts go live on October 2025. This is a rebellion against complexity.

China asks brokers to pause real-world asset business in Hong Kong

China's securities watchdog has advised some local brokerages to pause their real-world asset (RWA) tokenisation business in Hong Kong, said two sources, signalling Beijing's concerns of a euphoric drive towards a booming digital assets market offshore. The RWA tokenisation process usually converts traditional assets such as stocks, bonds, funds and even real estate, into digital tokens traded on a blockchain.

Franklin Templeton Expands Tokenization Frontiers With Benji Platform

Franklin Templeton, the global investment powerhouse managing $1.6 trillion in assets, is expanding its proprietary Benji Technology Platform to the BNB Chain ecosystem. The move amplifies Benji's institutional-grade tokenization expertise by leveraging BNB Chain's technological strengths, including its scalable, low-cost infrastructure and high transaction throughput, to create a new class of on-chain financial assets.

Real-World Asset Funds in DeFi Protocols

Real-world asset (RWA) funds are now integrated into DeFi protocols, enabling users to earn yields backed by tangible assets like real estate, invoices, and bonds. Platforms like Centrifuge, Maple Finance, and Goldfinch connect physical-world cash flows to decentralized lending pools. This convergence brings stability and credibility to the DeFi ecosystem.

WORK Medical enters strategic partnerships in bid to explore RWA initiatives

Hong Kong kicked off a new era in its embrace of virtual assets on Aug. 1 with the official launch of a regulatory and licensing framework for virtual currencies known as stablecoins. A steady stream of Chinese companies has begun experimenting in the city with virtual assets and their underlying blockchain technology since then, covering a wide range of industries. Medical products seller WORK Medical Technology Group Ltd.

New Ethereum standard aims to set baseline for real-world asset tokenization

A coalition of Web3 companies has introduced a new Ethereum token standard designed to streamline compliance and reduce fragmentation in the growing real-world asset (RWA) sector. According to an announcement sent to Cointelegraph, the standard, ERC-7943, creates a minimal, modular interface designed to work across Ethereum layer-2s and Ethereum Virtual Machine (EVM) chains, while remaining agnostic to implementation and vendor-specific infrastructure.

Tokenized Agriculture: Farming the Future

Tokenized agriculture is transforming farming by enabling investors to own shares in crops, livestock, and farmland through blockchain-based tokens. This model improves farmer financing, ensures traceability, and offers investors exposure to essential food production. Projects in Kenya, Brazil, and Australia are proving its viability. This innovation links capital directly to the source of sustenance.

What Is Real-World Asset (RWA) Tokenization?

RWA tokenization is the process of converting ownership rights of real-world assets, including tangible and intangible assets, into digital tokens on a blockchain. A blockchain is a decentralized, distributed digital ledger that records transactions. The process of RWA tokenization essentially creates a digital representation of a real asset, allowing it to be traded, managed, and tracked on a blockchain.

Ripple’s Stablecoin Debuts on BlackRock-Backed Tokenization Platform

Ripple’s RLUSD stablecoin has been integrated into Securitize’s platform, allowing users to exchange shares in tokenized money market funds for the dollar-pegged asset. The feature was enabled through a smart contract, which now serves as another off-ramp for products offered by asset managers BlackRock and VanEck, according to a press release. It functions 24/7, allowing users to access instant liquidity, Ripple added.

Digital Art: NFTs and Provenance Tracking

Digital art is being revolutionized by NFTs, which provide verifiable ownership and provenance for digital creations. Artists now tokenize their work, ensuring authenticity, enabling royalties, and unlocking new revenue models. Platforms like SuperRare, Foundation, and Artsy are integrating blockchain to combat forgery and empower creators in the global art economy.

BNB Chain Takes Lead in RWA Tokenization

BNB Chain has stepped out front in the race to tokenize real-world assets. From gold to treasuries to equities, the network is putting its full stack to work. The build-out covers compliant issuance, secondary liquidity, and DeFi integration inside one ecosystem. Complete RWA Ecosystem The architecture integrates three core layers. The BNB Smart Chain handles secure execution with low fees and real-time finality. OpBNB powers high-throughput rollups

Breakthrough in Smart Finance and RWA Tokenization

ICICOIN is more than a cryptocurrency—it’s a robust ecosystem designed to transform global finance. By integrating artificial intelligence (AI) with blockchain technology, ICICOIN powers a high-performance platform for smart finance. Its capabilities include AI-driven market analysis, optimized asset allocation, risk management, and seamless smart contract execution. Unlike speculative tokens, ICICOIN’s real-world applications

Tokenized Wine: Investing in Fine Vintages

Tokenized wine is turning rare vintages into tradable digital assets, enabling fractional ownership of bottles from Bordeaux, Burgundy, and Napa Valley. Blockchain ensures provenance, authenticity, and automated returns from appreciation and auctions. Platforms like Vinovest and Cult Wines are integrating tokenization. This model brings transparency and liquidity to a historically opaque collectibles market.

RWA Tokenization Poised to Revolutionize LATAM Markets

LATAM markets could be revolutionized through LATAM RWA tokenization since it will decrease expenses and increase access, concludes a new report by Bitfinex Securities. RWA asset tokenization is bringing new hope to Latin American capital markets. A recent report by Bitfinex Securities El Salvador shows how blockchain technology will reduce costs and break the barriers. The local economy has been saddled with chronic problems:

Bitget Introduces RWA Index Perpetual Contract to Trade Tokenized Shares

Cryptocurrency exchange Bitget has unveiled the world’s first Real-World Asset (RWA) Index Perpetual Contract. This product allows users to gain exposure to tokenized versions of traditional assets like Tesla (TSLA), Nvidia (NVDA), and Circle (CRL). By blending traditional finance (TradFi) and decentralized finance (DeFi), Bitget aims to expand the horizons of digital asset trading. The new perpetual contracts, which went live on August 20, 2025

Fractional Aircraft Ownership via Tokens

Fractional aircraft ownership is being transformed by tokenization, allowing investors to own shares in private jets through blockchain-based digital tokens. This model reduces costs, increases utilization, and enables transparent revenue sharing from charter flights. Companies like JetSmarter and FlyExclusive are exploring on-chain models. This innovation makes private aviation accessible beyond the ultra-wealthy.

Asia Pacific Advances RWA Tokenization in 2025

APAC economies Singapore, Hong Kong, Australia, Japan accelerating real-world asset tokenization through regulatory reforms. Tokenization improves settlement, custody transparency, enables 24/7 markets while reducing capital costs significantly. Interoperability standards focus on central bank money, KYC alignment, cross-border connectivity challenges. APAC economies, including Singapore, Hong Kong, Australia, and Japan, are accelerating real-world asset (RWA) tokenization

Shariah-Compliant Tokenized Invoice Financing to Bridge DeFi and Embedded Finance

SILQFi, the financial arm of SILQ Group, has partnered with Helix, a leading RWA tokenization protocol, to launch a first-of-its-kind shariah-compliant tokenized invoice financing initiative in the Gulf. This collaboration combines Helix’s on-chain infrastructure with SILQFi’s regional expertise to channel stablecoin capital into real-world financing for small businesses, advancing financial inclusion across the region.

© 2026