IT IS YOUR MONEY

Can the Bitget RWA index contract activate new variables in the trillion-level US stock market?

The US stock market is a vibrant and exciting one, with a constant stream of impressive unicorns and entrepreneurial success stories, such as Nvidia, which soared to the top of the market after a meteoric rise in market capitalization. This has attracted many Chinese-speaking investors eager to try their hand. However, obstacles such as high transaction fees, cumbersome account opening procedures,

Real-World Asset Tokenization Market Has Grown Almost Fivefold in 3 Years

The real-world asset (RWA) tokenization market has grown by 380% in just three years, reaching $24 billion this month in a sign that traditional finance is finding benefits from embracing blockchain technology, according to a report from RedStone, Gauntlet and RWA.xyz. "Asset tokenization has decisively transitioned from experimental pilots to scaled institutional adoption in 2024-2025," the Real-World Assets in On-chain Finance Report concluded.

Bitcoin Treasury Integration and RWA Tokenization

"Tokenization is no longer a concept—it's an inevitability," said Jason Dussault, CEO of Intellistake. "By combining our expertise in capital markets and digital asset custody with PowerBank's scalable, real-world energy platform, we're unlocking a new opportunity.." As institutions and sovereign funds increasingly embrace tokenized securities and decentralized asset strategies,

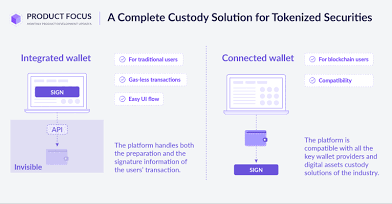

Digital Asset Custody: Safeguarding Value

Digital asset custody is critical for securing tokenized real-world assets, cryptocurrencies, and security tokens. Institutional-grade solutions combine cold storage, multi-sig wallets, and insurance to protect holdings. Firms like Fireblocks, Coinbase Custody, and Sygnum serve investors, funds, and enterprises. As digital assets grow, robust custody is the foundation of trust and compliance in the new financial ecosystem.

Advancing real-world asset tokenization with AI-driven infrastructure

At the Forefront of the RWA Revolution As the tokenization of real-world assets shifts from experimentation to full-scale adoption, Giants Protocol is delivering the AI-powered infrastructure to lead this next wave. Giants transforms traditionally complex investment products into seamless, on-chain, yield-generating opportunities.

Hong Kong Seizes the RWA Trend: Infrastructure, Ecosystem Scale, and Industrial Chain

How to become the world's leading digital asset center? After a series of favorable policies for the development of digital assets were successively announced, how to gradually improve the infrastructure and product ecosystem has become an issue facing Hong Kong. "The (industry) attention is very high, especially after the Hong Kong government issued the declaration.

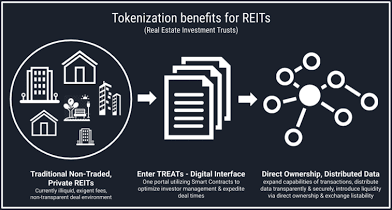

Real Estate Investment Trusts Go On-Chain

Real Estate Investment Trusts (REITs) are moving on-chain, combining the income stability of traditional REITs with the efficiency of blockchain. Tokenized REITs offer fractional ownership, 24/7 trading, and automated dividend distribution. Firms in the U.S., Europe, and Asia are launching digital versions of commercial and residential portfolios. This shift enhances liquidity and global investor access.

The Tokenization of Real-World Assets (RWAs) and its Impact on Corporate Liquidity

The conversation around digital assets often defaults to speculative cryptocurrencies. However, a far more impactful evolution is quietly gaining momentum: the tokenization of real-world assets (RWAs). This process transforms tangible and intangible assets—from real estate and commodities to invoices and intellectual property—into digital tokens on a blockchain. For corporate treasury, this isn’t just a technical novelty;

Why stablecoin issuers are spinning up their own blockchains

Stablecoin issuers are building their own blockchains to snap up a bigger chunk of the massive transaction fees generated by the $277 billion market. “Launching a dedicated chain gives issuers more control over settlement and compliance, but it also opens the door to new revenue from fees and network activity,” Ben Reynolds, managing director of stablecoins at BitGo, a crypto infrastructure company, told DL News.

Boost Loyalty with Tokenized Digital Benefits (Rewards, Vouchers & Cashback)

In today's competitive market, customer loyalty is earned, not given. Traditional programs are no longer enough. To truly engage modern consumers, businesses are turning to dynamic digital strategies. Integrating Digital Benefits Vouchers, Cashback, and Rewards isn't just a trend—it's a fundamental shift towards creating a seamless, value-driven customer experience that fosters lasting connections and drives repeat business.

RWA tokenization body ERC3643

The Depository Trust & Clearing Corporation (DTCC) has joined the ERC3643 Association, the body that oversees the ERC-3643 standard for permissioned real world assets (RWA) tokens. The standard was initially created by Tokeny, and when the DTCC unveiled its ComposerX solution for tokenization in January, it said that ERC-3643 was one of the main standards it supports. The association now has at least 20 members, including fund administrator Apex and Invesco.

Featured In White House Report As Key Player In RWA Tokenized Finance

This momentum reached a new milestone yesterday when the White House, through the President’s Working Group on Digital Asset Markets, officially recognized Ondo Finance in a new report. The report highlights tokenized securities, stablecoins, and programmable settlement as foundational to the future of the global financial system—and named Ondo among the key players leading that shift.

Tokenized Shipping Containers: Trade Finance 2.0

Tokenized shipping containers are revolutionizing global trade by enabling fractional investment in maritime logistics assets. Each container is represented as a digital token backed by real-world value, generating rental income from shipping lines. Platforms like Shipyard and SeaChain are leveraging blockchain for transparency, automated payouts, and risk diversification. This model unlocks new income streams for investors and capital for operators.

Tokenized US Stocks on Ethereum for 24/5 Trading

According to eToro, the goal is to bridge traditional finance and decentralized finance by giving users full control over their tokenized assets. “Yes, that is 100% the objective here,” a company spokesperson said when asked if users could move assets into self-custody. That means you could, for example, buy tokenized Tesla shares on eToro, move them into your own Ethereum wallet, stake or lend them via a DeFi app, and return them to the platform later if needed.

Tokenization of Real-World Assets: Opportunities, Challenges and the Path Ahead

Digital assets are no longer just the playground of fintech startups. Mainstream financial institutions now offer token-friendly custody and settlement, global exchanges are piloting digital-asset divisions, and traditional asset managers are dipping their toes into tokenized share classes. For established players, the appeal is clear: smoother operations, faster settlements and a bigger pool of potential investors.

Music Royalties as Tradable Digital Assets

Music royalties are being transformed into tradable digital assets, allowing artists and investors to tokenize future earnings from streams, downloads, and licensing. Blockchain enables transparent, automated royalty distribution and secondary market trading. Platforms like Royal and Opulous are empowering creators while offering investors predictable returns. This innovation is reshaping the economics of the music industry.

Bitcoin DeFi surges, but tokenization and stablecoins gain steam

Decentralized data infrastructure provider Inveniam Capital has invested $20 million in layer-1 blockchain Mantra to bring institutional-grade real-world assets (RWAs) to the blockchain, complete with asset reporting and surveillance. The companies say the partnership could significantly boost total value locked (TVL) on Mantra Chain and promote compliant tokenization at a time when RWA adoption is expanding rapidly.

On-Chain RWA Tokenization Nears Peak Levels

“When Larry Fink says all stocks, bonds, and real estate can be tokenized, believe him,” said crypto asset manager Bitwise on Wednesday. The comment in reference to the BlackRock boss came alongside a chart showing that real-world asset (RWA) onchain value had surged to an all-time high of just under $25 billion. More recent data from RWA.xyz reveals that it is currently at $25.46 billion, which is close to record highs.

Future-Proof Your Profits: Mastering the New Payment Landscape

The paradigm of value exchange is undergoing its most radical transformation in centuries. The convergence of blockchain technology, evolving legacy systems, and innovative payment platforms is not just changing how we pay—it's redefining the very architecture of global finance. For businesses, this shift presents an unprecedented opportunity.

RWA Tokens Take Flight as Investors Turn to Asset-Supported Alternatives

Dissecting Real-World Asset Tokens At their essence, real-world asset tokens serve as digital avatars for tangible entities, whether that's real estate, commodities, or securities. In leveraging blockchain technology, the RWA landscape is transforming investment practices by augmenting liquidity and transparency. As the appetite for reliable, asset-backed options intensifies, these tokens are increasingly viewed as safe havens during turbulent market phases

© 2026