IT IS YOUR MONEY

Empower the future of Real World Asset (RWA) tokenization

Velo Protocol announced today that it is developing Velo Orbit Plus, a super app that serves as an integrated digital platform designed to reshape how users and businesses interact with tokenized assets, stablecoins, and real-world value transfers. Orbit Plus marks a significant milestone in the Velo roadmap, co-developed with EVOLVE and Lightnet Group, driving the next generation of real-world asset (RWA) tokenization and settlement.

"DAF" Digital Assets Foundation: Building a Trusted Digital Asset Ecosystem

The financial world is at a pivotal juncture. Traditional systems, while established, often exclude billions from wealth-building opportunities due to high barriers and inefficiencies. The Digital Assets Foundation (DAF) is leading a paradigm shift by harnessing blockchain to create an inclusive, transparent, and secure global financial ecosystem. Through the tokenization of real-world assets (RWAs)

NFTs vs. RWA Tokenization – The Future of Digital Asset Ownership

our world becomes progressively digital, the conversation is getting noisy, with the concept of ownership is also going through a profound transformation. We’re moving beyond mere physical possession of assets and exploring new ways of ownership, trading, and managing them. For many, the terms ‘digital assets’ conjure images of unique digital items and NFT art collections that have intrigued and enthralled the masses.

Cardano Drives RWA Tokenization Forward

Cardano is making significant strides in the real-world asset (RWA) tokenization sector. The network recently partnered with the London Stock Exchange Group (LSEG) on a major project. This collaboration focuses on the tokenization of reinsurance-backed assets, marking a milestone for Cardano’s involvement in RWA tokenization. Cardano Partners with LSEG to Tokenize Reinsurance Fund In a recent move, LSEG welcomed Members Capital Management (MembersCap) to open the market.

RWA Platforms: Gateways to On-Chain Assets

RWA platforms are emerging as gateways that connect traditional assets to blockchain networks, enabling seamless tokenization of real estate, bonds, and private credit. Firms like DigitalNetwork.International, Centrifuge, ADDX, and Securitize provide end-to-end infrastructure for issuance, custody, and trading. These platforms are becoming the backbone of the digital asset economy, bridging institutional finance with decentralized markets.

Real-World Asset Tokenization Poised for Trillions in Growth

The financial world is on the cusp of a revolutionary transformation, as Real-World Asset (RWA) tokenization, leveraging blockchain technology, moves from a niche concept to a mainstream financial force. This burgeoning trend involves converting ownership rights of tangible and intangible assets into digital tokens on a blockchain, promising to unlock unprecedented liquidity, enable fractional ownership, and enhance transparency across traditional sectors

Top 10 Digital Currencies for Cross-Border Payments in 2025

Sending money across countries has always been slow and expensive. Banks usually take several days and charge high fees for international transfers. In 2025, digital currencies are changing how money moves between countries. They make sending money faster, cheaper, and easier. Here are the top 10 digital currencies used for cross-border payments this year. US Dollar-backed Stablecoins (USDT, USDC, RLUSD) Stablecoins such as Tether, USD Coin, and Ripple's RLUSD are virtual currencies

Tokenized Yachts: Luxury Asset Fractionalization

Tokenized invoices are transforming accounts receivable into liquid digital assets, enabling businesses to unlock working capital instantly. By representing outstanding invoices as blockchain-based tokens, companies can sell them to investors or use them as collateral in DeFi lending protocols. Platforms like Centrifuge and Orixo are pioneering this model, improving cash flow without traditional factoring delays.

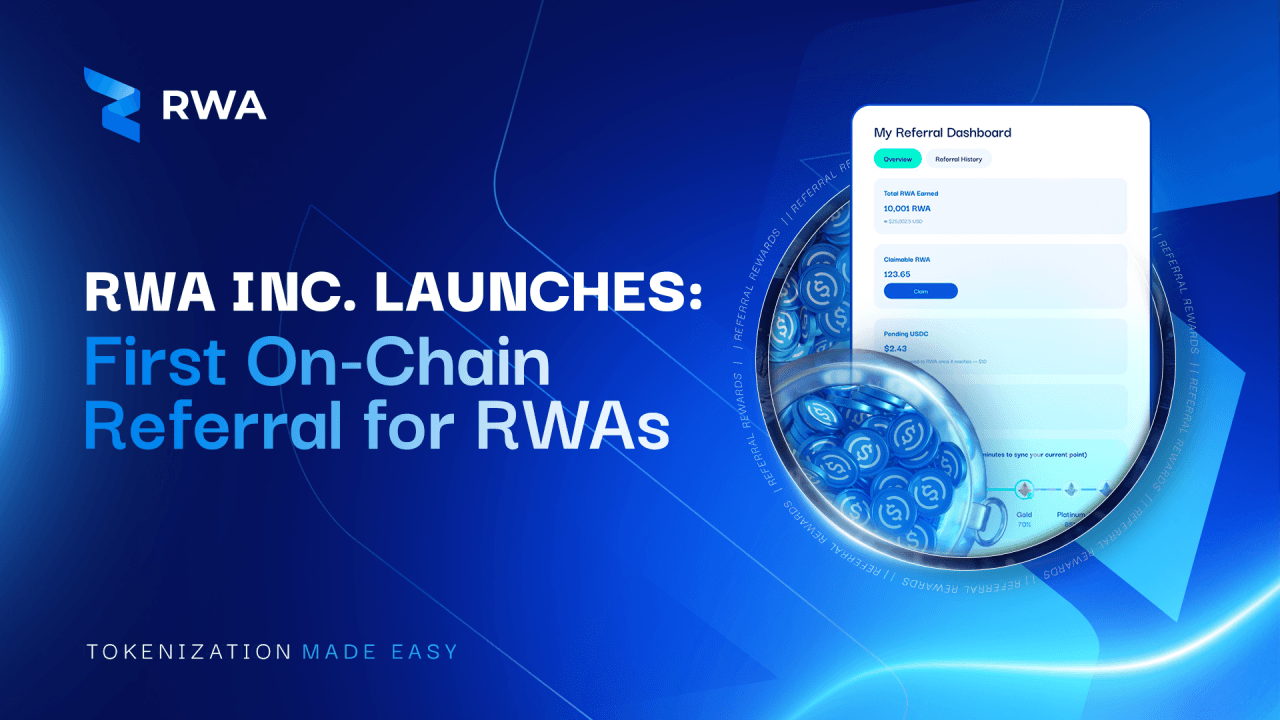

RWA Inc. Launches First-Ever On-Chain Referral System for Real-World Asset Tokenization

The future of finance is being built on a fully on-chain and transparent foundation. RWA Inc., a leading infrastructural ecosystem for Real World Asset (RWA) tokenization, has unveiled the industry’s first on-chain referral system on its investor platform. This launch creates a unique opportunity for early adopters, key opinion leaders (KOLs), and investors to earn passive income while supporting the fast-growing RWA market.

The Future of Real World Asset Tokenization and Crypto Treasury Management

we peer into the future of finance, one thing is becoming clear: the tokenization of Real World Assets (RWAs) is set to change the game, potentially unlocking trillions by 2030. It’s a big deal, and it’s going to be interesting to see how this plays out. So, what’s this all about? What Are Real World Assets? RWAs are the physical and intangible assets that exist in our everyday lives. Think real estate, commodities, and various financial instruments.

Digital Securities Tokenization: Compliance by Design

Digital securities are transforming capital markets by embedding regulatory compliance directly into blockchain-based tokens. Using standards like ERC-3643, issuers automate investor accreditation, transfer restrictions, and reporting—ensuring adherence to global securities laws. Platforms like Polymath, Tokeny, and Securitize are enabling compliant fundraising at scale. This innovation reduces risk and cost while expanding access.

How This Blockchain is Revolutionizing Real-World Assets

The tokenization of Real-World Assets (RWAs) is revolutionizing the financial landscape, bridging the gap between traditional finance (TradFi) and decentralized finance (DeFi). At the forefront of this transformation is Mantle, a blockchain ecosystem leveraging its modular Layer-2 (L2) architecture to deliver unmatched scalability, liquidity, and capital efficiency. With a focus on institutional-grade tokenization

Transfer agent for tokenized securities

Plume Network will fulfill the role of traditional transfer agents, which handle trades, records, and dividends. The L2 chain will be able to supply all those data points and report directly to the SEC. Plume Network offers transfer agent services to third parties and funds, with fast onboarding and full compliance. Plume Network has worked with the SEC for transparent reporting The status of an official transfer agent arrives

Tokenized Private Debt: New Income Streams

Tokenized private debt is creating new income opportunities by bringing corporate loans, SME financing, and structured credit onto blockchain networks. Investors gain access to diversified, yield-generating assets backed by real-world repayments. Platforms like Maple Finance, Clearpool, and Centrifuge are leading adoption. This innovation enhances transparency and efficiency in alternative lending markets.

Alpaca rolls out network enabling direct tokenization of US stocks

US broker-dealer Alpaca has launched an Instant Tokenization Network (ITN) that allows institutions to mint and redeem tokenized US stocks directly, a move that could help boost onchain liquidity in a segment of the tokenization market still constrained by structural barriers. The ITN enables institutions to tokenize portfolios with a single API call and redeem tokens in-kind for the underlying shares without settlement delays

Ethereum Dominates Tokenized RWA Market with 72% Share

Analysts point to Ethereum’s liquidity depth, composability with decentralized finance protocols, and regulatory-compatible standards like ERC-1400 and ERC-3643 as critical drivers of this long-lasting dominance. These features make the blockchain an attractive foundation for institutions seeking programmable, transparent, and efficient capital deployment. Carlos Domingo, CEO of Securitize, has called 2025 the year when RWAs found genuine on-chain utility

Blockchain-Based Land Registries Prevent Fraud

Regulatory sandboxes are enabling safe experimentation with tokenized real-world assets by allowing startups and financial firms to test blockchain solutions under relaxed rules. Jurisdictions like the UK, Singapore, and Switzerland host these controlled environments to balance innovation and investor protection. These sandboxes are accelerating the responsible adoption of digital asset technologies across global markets

Kraken lobbies SEC to integrate tokenization into financial markets

An internal agency memo confirmed that the exchange met with the task force on Aug. 25 to present ideas on how tokenized trading systems might function under existing US law. During the session, Kraken’s presentation outlined the architecture of such a system, explained the lifecycle of various transaction types, and examined the legal obligations tied to securities regulations. The crypto exchange also pressed for clearer regulatory guidance

Why Hong Kong Is Driving RWA Tokenization Despite Steep Costs

Hong Kong ETFs Show Investor Appetite. ETF trading patterns reveal a clear preference for Ethereum-based products. China Asset Management’s Ethereum ETF led turnover at nearly HK$26 million on August 26. Bitcoin product and those of rival issuers Harvest and Bosera drew smaller volumes. Ethereum-linked ETFs accounted for almost two-thirds of activity. Analysts say this reflects global trends

Tokenized Invoices: Unlocking Working Capital

Tokenized invoices are transforming accounts receivable into liquid digital assets, enabling businesses to unlock working capital instantly. By representing outstanding invoices as blockchain-based tokens, companies can sell them to investors or use them as collateral in DeFi lending protocols. Platforms like Centrifuge and Orixo are pioneering this model, improving cash flow without traditional factoring delays.

© 2026