IT IS YOUR MONEY

RWA Tokenization vs. NFTs and Why the Difference Matters

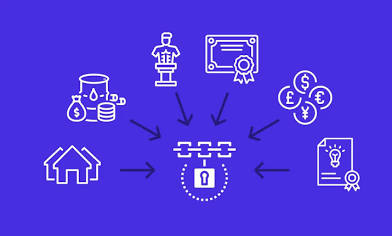

In our increasingly digital world, the concept of ownership is undergoing a profound transformation. We are moving beyond just physical possession to explore new ways of owning, trading, and managing assets. Two terms that frequently appear in this conversation are Real World Asset (RWA) Tokenization and Non-Fungible Tokens (NFTs). While both are rooted in blockchain technology, they represent fundamentally different approaches to digital ownership

Tokenized Venture Capital Funds Emerge

Tokenized venture capital funds are transforming early-stage investing by enabling fractional ownership, transparent governance, and secondary liquidity through blockchain. Startups and fund managers now issue digital shares that automate distributions and compliance. Firms like SPiCE VC and Antler are pioneering this model, attracting global investors while reducing administrative friction. This evolution is making VC more accessible and efficient.

Tokenized stocks rise 220% in July, reminiscent of ‘early DeFi boom’

Tokenized stocks may be approaching a tipping point as investor demand for blockchain-based financial products surges, potentially accelerating the adoption of traditional assets onchain. Tokenized stocks, which are part of the growing real-world asset (RWA) tokenization sector, reached a $370 million market capitalization by the end of July, according to a Wednesday Binance Research report shared with Cointelegraph.

Guide on Gold Tokenization: How to Build a Tokenized Gold Platform

RWA tokenization companies are making it easier than ever to invest in tangible assets, without the traditional complexity. In this blog, we'll dive into the key reasons behind this explosive growth in RWA tokenization and why 2025 is becoming a turning point for the future of asset ownership and blockchain finance. Why Invest in RWA Tokenization Solutions? Tokenizing real-world assets brings a wiser and more accessible method of owning assets in place.

Carbon Credits Go Digital with Blockchain

Carbon credits are being digitized using blockchain to improve transparency, prevent double-counting, and streamline trading in the fight against climate change. By tokenizing verified emissions reductions, platforms ensure authenticity and enable real-time settlement. Projects in Africa, Southeast Asia, and Latin America are leveraging this innovation to unlock green financing. This shift is making carbon markets more trustworthy and scalable.

RWA Crypto Sector Emerges as Day’s Top Performer

The ongoing four-year crypto structural change has seen an increasing demand for RWA tokens. Hong Kong is the latest in a series of countries approving clear and friendly regulations for real-world assets tokenization. RWA’s crypto assets with significant institutional backing have rebounded more today. The crypto assets in the Real-World Assets (RWA) tokenization sector were the top-performing category

Real Assets Are Being Digitized with Blockchain

The world of finance is undergoing a digital renaissance. While cryptocurrencies initially captured attention, the true evolution is now happening in the domain of real-world asset (RWA) tokenization. This process transforms tangible assets—like real estate, art, commodities, and private equity—into digital tokens secured by blockchain technology. It’s a shift that’s not only revolutionizing traditional finance

Tokenized Insurance: Faster Claims, Lower Costs

Tokenized insurance leverages blockchain and smart contracts to automate policy issuance, premium payments, and claims processing—reducing fraud, administrative overhead, and settlement delays. From crop insurance to flight delay coverage, decentralized models are emerging that offer transparency and efficiency. Companies like Etherisc and AXA are pioneering on-chain insurance, signaling a shift in how risk is managed globally.

Asset tokenization firm Provenance to launch marketplace

Animoca Brands and Provenance Blockchain Labs have partnered to launch Nuva, a marketplace for tokenized real-world assets, with rollout planned in Q4 2025. Animoca Brands is a blockchain firm based in Australia, while Provenance Blockchain Labs develops infrastructure for tokenizing assets. Nuva will offer investment products from various issuers, including institutional-grade vaults backed by Figure Technologies’ stablecoin and home equity loans.

Why The GENIUS Act May Benefit RWA Tokenization Companies The Most

Tokenization Companies Gain Regulatory Clarity Dave Hendricks, CEO and founder of Vertalo, told Cryptonews that while the passage of the GENIUS Act provides large financial institutions with regulatory clearance to implement distributed ledger technology (DLT), the beneficiaries of the GENIUS Act are technology companies. “Companies like Vertalo that enable institutions to issue and manage tokenized products and stablecoins are the real winners here,”

Stablecoins: Digital Cash for Global Payments

Stablecoins are digital currencies offering the speed of crypto with price stability. Used for cross-border remittances, DeFi transactions, and institutional settlements, they bridge traditional and digital finance. With over $130 billion in circulation, major players like USDC, USDT, and emerging regulated issuers like YemFounfation.com issuer of YEM (You Everyday Money) are reshaping how value moves globally. Their role in banking, trade, and everyday payments are expand rapidly.

About Real-World Assets (RWAs) in Cryptocurrency?

When the shipping container debuted in 1956, it looked like little more than a steel box. Yet standardized containers soon rewired global trade by letting cargo move from trucks to ships to trains without repacking. Similarly, tokenization aims to do something just as radical for ownership records by imprinting an asset's paperwork onto a crypto token that can live on any blockchain where code can run. And it's the promise of this concept

Tokenized Stocks: Bringing Real-World Equity On-Chain

Creating a token derivative that requires only a price tracking mechanism is the easiest way to "tokenize" an asset. Earlier examples include now-sunset Synthetix's sStocks and Mirror Protocol's mAssets on Terra, where tokens track asset prices via oracles and are minted against some crypto collateral. Similarly, gTrade (Gains Network) offers synthetic stock trading where positions are derivative contracts backed by collateral pools like USDC or DAI.

Smart Contracts Automate Asset Management Tokenization.

Smart contracts are self-executing agreements coded on blockchain that automate asset management processes like dividend distribution, compliance checks, and ownership transfers. Used in tokenized real estate, funds, and bonds, they reduce administrative costs and human error. Platforms like Ethereum and Polygon enable secure, transparent execution. This technology is transforming how assets are governed and maintained.

Digital Currencies Integration and RWA Tokenization

As institutions and sovereign funds increasingly embrace tokenized securities and decentralized asset strategies, the Intellistake–PowerBank partnership centres on transforming legacy energy systems into a tokenized product. According to a recent report by CryptoSlate, analysts forecast that the market cap for tokenized real-world assets (RWAs) could reach $30 trillion by 2034(1)—driven by advances in blockchain, AI, and investor demand

Tokenize $1B in Real-World Assets on XDC Network

The migration shifts VERT’s existing securitization work, which includes clients like Cargill, Santander and Raízen, towards digital issuance with a blockchain-based infrastructure designed to meet regulatory and audit requirements. "Our goal is to transform traditional structured assets into digital assets with global liquidity," Gabriel Braga, head of digital assets at VERT, said in statement.

Tokenization Reduces Real Estate Entry Barriers

Tokenization is dramatically lowering entry barriers in real estate by enabling fractional ownership, reducing minimum investments from millions to hundreds of dollars. Blockchain-based platforms allow global investors to buy shares in high-value properties with transparency and liquidity. From Manhattan condos to Dubai villas, tokenized real estate is democratizing access to one of the world’s most valuable asset classes.

Permissionless Lending for Tokenized Real-world Assets

Brickken, the institutional-grade platform powering compliant real-world asset (RWA) tokenization, has announced a new partnership with Credefi, a leading decentralized lending protocol bridging traditional finance and DeFi. Together, the two platforms are enabling a permissionless lending environment for tokenized real-world assets, starting with equity tokens created through Brickken’s infrastructure. This integration allows users on Credefi to borrow and lend USDC

Dubai Sets RWA Milestone With First Approval of Tokenized Money Market Fund

The Dubai Financial Services Authority (DFSA) granted regulatory approval to QCD Money Market Fund (QCDT), making it the first tokenized money-market fund with an official set-up in the Dubai International Financial Centre (DIFC), according to Qatar National Bank (QNB), while DMZ Finance, the companies behind the fund. The fund's investment strategy and asset origination is led by Qatar National Bank while DMZ Finance provides the technology underpinning its digital architecture

Digital Identity and Asset Ownership Security

Digital identity is the cornerstone of secure asset ownership in the blockchain era, enabling verified, self-sovereign control over digital and tokenized assets. By linking identity to wallets via decentralized identifiers (DIDs), users can prove ownership, comply with regulations, and prevent fraud. Projects like SafeIdent (safeident.com) Customer Verification Service Using SafeDataShare (SDS) Technology are advancing this critical infrastructure unlocking trust in the digital finance ecosystem

© 2026