IT IS YOUR MONEY

Tokenized Real-World Assets Market Expected to Reach US$18.9 Trillion by 2033

The market for tokenized real-world assets has grown significantly overt the past years and is projected to accelerate even further over the next decade. Between 2025 and 2033, the market is expected to achieve a compound annual growth rate (CAGR) of 53%, soaring from US$600 billion to US$18.9 trillion, according to a new report by digital asset infrastructure provider Ripple, and Boston Consulting Group (BCG).

Digital Assets and RWA: Transforming the Way We Invest in Urban Mobility and Smart Transportation

Urban mobility is undergoing a transformation as cities adopt electric vehicles, autonomous transport, and shared mobility solutions. Digital assets and real world assets (RWA) are enabling tokenized investment in transportation infrastructure, vehicle fleets, and smart transit systems that improve efficiency and attract capital

Bridging Real-World Assets and Crypto Markets: The Next Frontier of Tokenization

Tokenized Assets Meet Crypto Exchanges: A New Era of Market Access Across today’s blockchain landscape, the range of uses for tokenized assets continues to expand. Property tokens are now integrated into digital investment vehicles, commodity-backed instruments are being put to work in lending protocols, and even government bonds, once the realm of slow-moving institutions, are starting to appear in decentralized financial systems.

Better, faster, cheaper: Multibank tokenization networks

Businesses are calling on banks to offer faster and more efficient cross-border payment capabilities. These organizations may encounter high transaction costs, slow payment speeds, and unclear settlement times when moving money internationally, which can hamper their relationship with banking partners.1 At the same time, fintechs appear poised to continue capturing a larger share of the cross-border payment

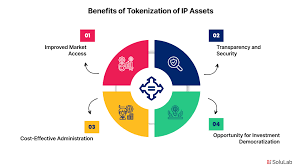

Tokenization: The next charter Intellectual property (IP) licensing is a complex and oftMarketplaces

Intellectual property (IP) licensing is a complex and often opaque process, especially for independent creators and small businesses. Digital assets and real world assets (RWA) are streamlining this ecosystem by enabling decentralized IP marketplaces, automated royalty distribution, and transparent licensing agreements powered by blockchain technology.

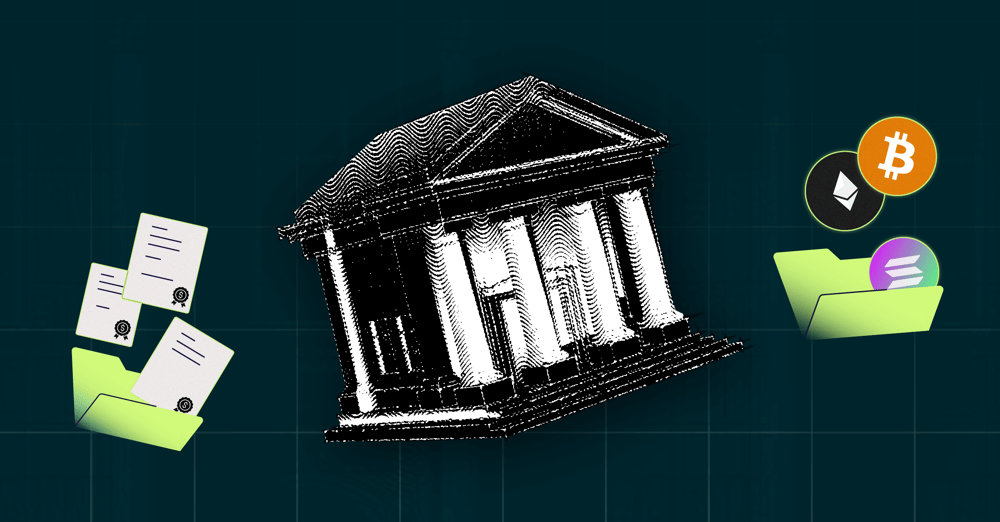

Tokenization projects will soar among financial institutions

The tokenization of assets - which involves using the blockchain to record the ownership of digital assets, other financial assets, commodities, or real-world property - is a blockchain-and crypto-related innovation that has received significant interest from financial institutions around the world. A growing number of banks are launching tokenization projects and pilots to identify ways to enhance efficiencies in the processing and delivery of services.

The Tokenization Revolution

The perfect storm for tokenization We’re currently witnessing a convergence of factors that are creating the ideal foundation for broader adoption of tokenization. For one, regulatory bodies worldwide are stepping up, issuing and implementing policies that create much-needed guardrails for this innovative space. Simultaneously, mature and credible regulated players are entering the tokenization space, building trust and expanding the ecosystem.

Tokenizing Education Credentials and Academic Verification

Education credentials play a vital role in employment, immigration, and professional advancement, yet traditional verification systems are slow, centralized, and prone to fraud. Digital assets and real world assets (RWA) are addressing these issues by enabling self-sovereign credentials, instant verification, and immutable academic records that empower students and institutions.

Trump-era policies may fuel tokenized real-world assets surge

The tokenization of real-world assets (RWA) has become a key focus for traditional finance companies aiming to build bridges to decentralized finance (DeFi), improving liquidity, accessibility and transparency with RWA transactions. Four days before US President-elect Donald Trump takes office on Jan. 20, Cointelegraph interviewed Eli Cohen, general counsel of the RWA tokenizing platform Centrifuge, to discuss trends he expects to see in 2025.

How the Tokenization of Financial Assets is Transforming Financial Services

The market for tokenized financial assets is expanding at a breakneck pace. The total value of tokenized assets is expected to reach $6 trillion this year and soar to nearly $19 trillion by 2033—a staggering compound annual growth rate of 53%. This rapid expansion is driven by a convergence of structural and market forces, including regulatory advancements, technological breakthroughs, growing institutional adoption and investor demand.

Tokenization: A Game Changer for Aviation Leasing and Aircraft Financing

Aircraft leasing and financing are complex due to high costs, regulatory hurdles, and illiquid secondary markets. Digital assets and real world assets (RWA) are introducing transformative solutions by enabling tokenized aircraft ownership, automated lease agreements, and transparent asset tracking that streamline aviation finance.

Tokenized Asset Coalition Announces New Member Cohort

The Tokenized Asset Coalition champions the adoption of public blockchains, asset tokenization and institutional DeFi to dramatically alter the way capital is formed, invested and managed onchain. The TAC was formed in the fall of 2023 by Aave, Centrifuge, Circle, Coinbase, Base, RWA.xyz and others, and now includes over 40 leaders in tokenization. The 2024 report examines regulation's role in adoption

How Tokenization Is Reshaping Global Markets

The financial industry is undergoing one of the most transformative shifts in history, fueled by blockchain technology and digital assets. Among these advancements, tokenization stands out as a game-changer, poised to revolutionize asset ownership, investment accessibility and global liquidity. But how exactly is tokenization reshaping the financial markets, and what does the future hold for investors?

Tokenizing Next Generation of Cultural Heritage Preservation and Museum Funding

Cultural heritage sites and museums face ongoing challenges related to preservation, funding, and visitor engagement. Digital assets and real world assets (RWA) are introducing new tools for fundraising, artifact authentication, and interactive storytelling that preserve history while engaging global audiences.

What Is Asset Tokenization? Transform Your Financial Portfolio

Real-world assets like real estate or art don’t come cheap. The barrier of entry is sometimes extremely high, which makes people shy away from owning a piece of them. Asset tokenization solves this and creates digital tokens of physical assets you can easily trade and store. These tokens are on blockchain, making the transactions transparent and secure. Asset tokenization platforms let businesses and individuals manage these assets

Wecan Tokenize releases end-to-end tokenization solution

Wecan Tokenize, a platform in tokenization solutions for real estate professionals, today announced the release of its first tokenization solution with end-to-end integration for banks and financial institutions. In partnership with METACO, a provider of security-critical infrastructure enabling financial institutions to enter the digital asset ecosystem, Wecan Tokenize will expand its existing suite of services

Tokenization is Unlocking New Opportunities in Maritime Tourism and Cruise Line Investmens

The maritime tourism industry—including cruise lines, yachting, and coastal resorts—is recovering from disruptions and seeking new ways to attract investment, enhance transparency, and improve guest experiences. Digital assets and real world assets (RWA) are playing a key role in this transformation by enabling tokenized ownership, loyalty programs, and secure investment vehicles.

Aptos Becomes Top 3 Blockchain for RWA with $540M in Tokenized Assets

Real-world asset (RWA) tokenization on the Aptos blockchain has gained significant momentum in recent months, with the total value of onchain assets surpassing $540 million, driven by multiple deployments from traditional asset managers. The value of RWA deployments on the Aptos network has grown by 57.1% over the past 30 days, reaching $542.3 million, according to RWA.xyz data. This surge places Aptos among the top three blockchains for RWA deployment, behind Ethereum and ZKsync Era.

Tokenized US Treasurys increase market risk vectors

Tokenization is the process of converting real-world assets into digital tokens on a blockchain. In the case of US Treasurys, these tokens represent onchain claims to government debt, offering an alternative comparable to money market fund shares. The current market capitalization of tokenized US Treasurys stands at nearly $7.4 billion. According to a June report from rating service Moody’s

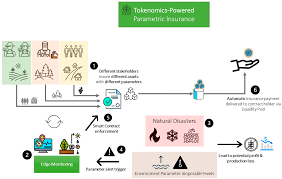

The Future of Tokenized Insurance Policies and Parametric Coverage

Traditional insurance models often suffer from slow claims processing, lack of transparency, and limited customization. Digital assets and real world assets (RWA) are changing this landscape by enabling tokenized insurance products, parametric coverage, and smart contract-driven policy management that improves efficiency and user experience.

© 2026