IT IS YOUR MONEY

Binance Report Shows 260% Growth in RWA Tokenization Market

Binance Research recently published a new report revealing that the RWA tokenization market experienced a significant 260% growth during the first half of this year. This growth is largely attributed to increasing regulatory clarity in the crypto space, which has driven broader adoption of blockchain-based financial products. The Binance report notes that the size of the RWA market has jumped to $23 billion during the first half of 2025

Blockchain Lending Boom: Tokenized Private Credit Nears $14 Billion

Tokenization addresses the core limitations of traditional private credit. By fractionalizing loans into blockchain-based tokens, proponents believe it broadens access for retail investors and enhances liquidity for historically illiquid assets. Smart contracts automate settlements, reducing administrative costs while onchain data ensures transparency in asset performance. The sector shows strong growth, adding approximately hundreds of millions monthly in new loans.

Digital Assets and RWA: The new ways to Wildlife Conservation and Biodiversity Protection

Wildlife conservation and biodiversity protection face chronic underfunding despite their critical importance to planetary health. Digital assets and real world assets (RWA) are offering innovative financing models that allow investors to directly support conservation efforts while generating sustainable returns.

Tokenization is having its breakout moment

Tokenization of real-world assets (RWAs) is evolving from an abstract concept to a practical financial tool as institutional players increasingly test and deploy blockchain-based infrastructure at scale. This past week alone saw a flurry of announcements from both traditional financial institutions and blockchain-native firms advancing their RWA initiatives.

Algorand Dominates Tokenized Stocks

Algorand leads tokenized stocks in 2025, outpacing Ethereum. The $425M Exodus stock on NYSE highlights the ALGO edge in RWA tokenization. By 2030, the industry could rise to command a market cap of over $1 trillion. Tokenization is the future, and with BlackRock, one of the world’s largest asset managers, at the forefront of this drive, the future looks bright for platforms that become industry leaders.

Digital Assets and RWA: Transforming How We Invest in Urban Development and Smart Cities

Urban development projects require long-term planning, large-scale capital, and stakeholder coordination. Digital assets and real world assets (RWA) are introducing innovative financing tools, transparent governance models, and participatory investment structures that are redefining how cities grow and evolve.

Real-World Asset Tokenization on XRP Ledger Is Here

BlocScale Launchpad is rewriting the narrative for the XRP Ledger, bringing real-world asset (RWA) tokenization to life while quickly establishing itself as the go-to launchpad platform for Web3 projects and businesses across emerging markets. As of March 2025, BlocScale has successfully raised over 14,000 XRP, surpassing its seed sale soft cap and capturing significant attention from the broader crypto community.

MultiBank Group Signs Strategic Partnership With MAG to Tokenize $3 Billion Real Estate Assets

DUBAI, United Arab Emirates--(BUSINESS WIRE)--MultiBank Group, the world’s largest financial derivatives institution based in Dubai has signed a historic $3 billion tokenization agreement with MAG, the leading real estate developer in the UAE, and Mavryk, a leading blockchain innovator — marking the largest real-world asset (RWA) tokenization initiative globally to date. The initiative highlights the imminent launch of $MBG, the utility token at the core of MultiBank’s

VanEck Launches Tokenized Fund Backed By US Treasury Securities

VanEck launched on Tuesday the 13th the VanEck® Treasury Fund, Ltd. (VBILL). This is the world’s first real-world asset (RWA) tokenization fund from the global asset manager. This was achieved through a partnership with Securitize, an RWA platform with total assets under management (AuM) of $3.9 billion (as of May 12). This volume is expected to increase soon, as VBILL was designed to provide investors with secure, real-time access to assets backed by the United States Treasury.

Digital Assets and RWA: Revolutionizing the Way We Invest in Space Mining and Resource Extraction

As space exploration advances, so does the potential for commercial resource extraction from asteroids, the Moon, and Mars. Digital assets and real world assets (RWA) are enabling tokenized ownership of extraterrestrial mining rights, investment pools, and revenue-sharing models that make space resource ventures more accessible and financially viable.

Taurus launches Solana-based custody and tokenization platform for banks

Taurus, a digital asset infrastructure firm, launched an enterprise-grade custody and tokenization platform, Taurus-Capital, on the Solana blockchain. Deutsche Bank-backed Taurus aims to serve global financial institutions seeking to build tokenized asset solutions. The integration will enable banks and issuers to custody and stake any Solana-native tokenized assets via the custody platform, Taurus-Protect, and to issue programmable tokenized assets on Taurus-Capital.

Hong Kong unveils digital asset policy 2.0 to boost stablecoin use, RWA tokenization

Policy Statement 2.0 on the Development of Digital Assets, outlining the next phase of its regulatory strategy. The update, which builds on the framework initially introduced in 2022, introduces a new “LEAP” framework designed to establish a trusted and innovation-driven digital asset ecosystem. The initiative targets four key areas, including legal streamlining, expanding tokenized products

Tokenization is unlocking New Opportunities in Legal Dispute Funding

Legal disputes often require significant capital to pursue justice, but traditional litigation funding is opaque, exclusive, and slow-moving. Digital assets and real world assets (RWA) are introducing new models that enable transparent, decentralized, and performance-linked investment in legal cases—making justice more accessible and financially viable for plaintiffs.

Inside the Rapid Growth of Real World Asset Tokenization

Tokenization of real world assets is all the rage and we have Chris Tyrrell, Chief Risk and Compliance Officer of Ondo Finance, to share their role as a frontrunner in tokenizing US treasuries. Chris shares regulatory compliance challenges, Ondo’s global operations and partnerships with major players like BlackRock, while showcasing future plans to expand into more asset classes and engage with both DeFi and traditional finance institutions.

RWA (Real World Assets): What is it? What is it used for?

Transforming physical world assets into “tokens” (cryptocurrency units) might appear quite unusual. In reality, we are witnessing the emergence of a market with immense potential. RWAs, or Real World Assets, represent a groundbreaking revolution that cannot be overlooked under any circumstances. On July 15, 2021, a remarkably original initiative was introduced by the Swiss bank Sygnum in collaboration with Artemundi, an American fund specializing in art.

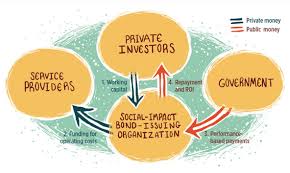

Tokenizing: A Game Changer for Philanthropy and Social Impact Bonds

Philanthropy and social impact investing are increasingly focused on measurable outcomes and efficient capital deployment. Digital assets and real world assets (RWA) are transforming this space by enabling transparent giving, performance-linked funding, and decentralized governance models that align donor intent with real-world impact.

Private Credit Leads RWA Tokenization Boom as Market Hits $24B

Private credit is now the largest sector of the real-world asset (RWA) tokenization market, according to the 2025 RWA in On-Chain Finance report by blockchain oracle RedStone published today, June 26. The report, conducted in collaboration with Gauntlet and analytics platform RWA.xyz, found that private credit now accounts for $14 billion of the $24 billion tokenized RWA market as of mid-2025.

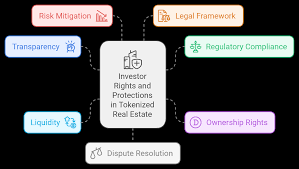

Real World Assets (RWA) on blockchain: the Revolution of Real Assets

RWA are real-world assets – such as real estate, government bonds, trade credits, gold, or art – that are tokenized on the blockchain. In practice, a physical asset is digitally represented in the form of a token, allowing for its trading, fractionalization, and integration with DeFi protocols. This evolution is redefining the very concept of finance: no longer closed and centralized systems, but an open, transparent, liquid, and global infrastructure.

Tokenizing Digital Assets and RWA: The Future of Luxury Fashion and Retail Investment

Luxury fashion and retail are evolving as brands seek new ways to engage customers, protect authenticity, and unlock capital. Digital assets and real world assets (RWA) are enabling tokenized ownership of designer collections, anti-counterfeit measures, and immersive consumer experiences that blend physical and digital worlds.

2025 is Critical for Scaling Tokenization

Boris Spremo, head of enterprise/financial services for software developer Polygon Labs, described the launch of the first fully regulated trading platform for tokenized real estate on the Polygon blockchain as “pivotal”, as he expects to see major capital deployments into tokenized assets this year. In March this year RealEstate.Exchange (REX) said in a statement that it had launched the first fully regulated trading platform for tokenized

© 2026