IT IS YOUR MONEY

The Investor’s New Playground: Where Digital Assets and RWA Meet Innovation

Investing used to be about stocks, bonds, and maybe a little real estate. Today, it’s a playground of innovation—where digital assets and real world assets (RWA) collide to create new opportunities in art, space, music, and beyond. The rules have changed, and the possibilities are endless.

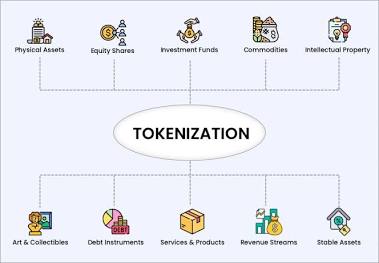

Real-world assets don’t live on the blockchain

There’s been much talk about tokenization and real-world assets (RWAs) over the past year or two. Even financial heavyweights like Larry Fink have weighed in, touting that BTC and Ethereum exchange-traded funds (ETFs) are “stepping stones” to the tokenization of everything. While browsing on X recently, I came across a post that sparked an old debate. Can RWAs exist on a blockchain, or will they always be IOUs (I owe you)

Goldman Sachs, BNY Launch Tokenization Service for $7 Trillion Funds Market

Goldman Sachs Group and Bank of New York Mellon Corporation have entered a collaboration to bring mirrored tokenization services to customers using BNY’s LiquidityDirect platform via Goldman Sachs’ blockchain-based Digital Assets Platform (GS DAP). The announcement, revealed in a press release on July 23, indicates that this is a “first-of-its-kind initiative” enabling BNY money market fund (MMF)

The Global Vault: How Digital Assets and RWA Are Creating Borderless Wealth

Wealth used to be tied to geography—your bank, your currency, your assets. Now, digital assets and real world assets (RWA) are creating a global vault —a unified, borderless financial system where anyone, anywhere, can store, grow, and transfer value instantly.

How To Launch An RWA Tokenization Project In Dubai In 2025

Real-world asset (RWA) tokenization is evolving from early security token offering (STO) experiments into a mainstream financial trend, and Dubai is leading the regulatory charge. With a newly introduced framework for issuing and trading asset-referenced tokens and political will to embed virtual assets into the capital markets, Dubai has great potential to become a global hub for asset issuers

Goldman Sachs and BNY Mellon Team Up for Tokenized Money Market Funds

BNY, which is one of the oldest and largest custody banks in the world overseeing $53 trillion of assets, announced on Wednesday to start offering institutional investors token versions of money market fund share classes via its LiquidityDirect platform. Ownership records and transactions are recorded on Goldman Sachs Digital Asset Platform's blockchain.

The End of Paper Promises: How Digital Assets and RWA Are Making Contracts Unbreakable

Paper contracts are fragile, forgeable, and often ignored. Digital assets and real world assets (RWA) are replacing them with unbreakable digital agreements—self-executing, transparent, and permanently recorded on the blockchain.

Tokenization must deliver real innovation, not regulatory loopholes

Tokenized securities must achieve success by delivering real innovation and efficiency to market participants, rather than through self-serving regulatory arbitrage,” Citadel wrote in a statement to the SEC’s Crypto Task Force, as reported by Bloomberg. Tokenization — the process of representing real-world assets on a blockchain with digital tokens — is often touted for its potential to reduce costs and boost efficiency

Why tokenization could reshape global finance

For centuries, certain asset classes have remained largely illiquid and inaccessible to the average investor. High-value real estate, masterpieces of art, luxury goods, and private equity stakes have traditionally been the exclusive domain of institutional investors or ultra-high-net-worth individuals, often requiring substantial capital outlays and enduring lengthy, complex transaction processes.

The Programmable Paycheck: How Digital Assets and RWA Are Reshaping Income Streams

The paycheck is evolving. No longer just a monthly deposit, income is becoming programmable —automated, diversified, and tied to real-world assets. Digital assets and real world assets (RWA) are powering this shift, enabling passive income from tokenized real estate, royalties, and decentralized finance.

Real estate tokenization: A new era for property investment and Luxembourg\'s strategic role

What is Real Estate Tokenization? Real estate tokenization is the process of converting the value of a physical property into digital tokens that can be bought, sold, or traded on a blockchain platform. Each token represents a fractional ownership stake in the property, allowing investors to participate in real estate markets without the need for substantial capital. This innovative approach not only enhances accessibility

Centralization and the dark side of asset tokenization — MEXC exec

Tracy Jin, the chief operating officer at the MEXC crypto exchange, warns that tokenizing real-world assets (RWAs) carries a substantial amount of centralized risks that can lead to censorship, liquidity issues, legal uncertainty, cybersecurity problems, and asset confiscation through state or third-party intermediaries. In an interview with Cointelegraph, the executive said that as long as tokenized assets

The Fractional Fortune: How Digital Assets and RWA Are Making Billion-Dollar Assets Accessible

You don’t need to be a billionaire to own a piece of a billion-dollar asset anymore. Digital assets and real world assets (RWA) are making ultra-high-value investments—like skyscrapers, private jets, and hedge fund stakes—accessible through fractional ownership, opening up wealth-building opportunities to millions.

Crypto tokenization aims to transform real-world assets

As cryptocurrencies become more intertwined with the traditional financial system, industry heavyweights are racing for a long-sought goal of turning real-world assets into digital tokens. “Tokenization is going to open the door to a massive trading revolution,” said Vlad Tenev, the CEO of the trading platform Robinhood at a recent James Bond-themed tokenization launch event in the south of France.

The Tokenization of Real-World Assets (RWAs) and its Impact on Corporate Liquidity

The conversation around digital assets often defaults to speculative cryptocurrencies. However, a far more impactful evolution is quietly gaining momentum: the tokenization of real-world assets (RWAs). This process transforms tangible and intangible assets—from real estate and commodities to invoices and intellectual property—into digital tokens on a blockchain. For corporate treasury, this isn’t just a technical novelty

The Invisible Handshake: How Digital Assets and RWA Are Automating Trust

In business, trust is everything—but it’s often slow, costly, and fragile. Digital assets and real world assets (RWA) are replacing manual trust mechanisms with automated, transparent, and tamper-proof systems—creating an “invisible handshake” that verifies, executes, and enforces agreements without intermediaries.

RGB Protocol to bring tokenized assets, USDT to Bitcoin

Smart contract and asset issuance system RGB Protocol said it had launched on the Bitcoin mainnet, enabling tokenized assets like stablecoins, non-fungible tokens (NFTs) and custom tokens within the Bitcoin ecosystem. On Thursday, the protocol announced that tokenization tools allowing users to create, send and manage digital assets on Bitcoin and the Lightning Network were available.

Tokenization Is Booming, But Without Legal Guardrails, It’s a House on Sand

In 2025, everything from real estate in Miami to U.S. Treasury bonds, even barrels of Scottish whiskey, can be traded as digital tokens on a blockchain. The real-world assets (RWAs) market has surged 260% in the first half of the year alone, according to Binance Research. Behind the growth is a simple idea: turning ownership of physical assets into programmable, tradable tokens. And that idea is quickly becoming a reality

No More Middlemen: How Digital Assets and RWA Are Cutting Out the Financial Fat

For decades, financial intermediaries—banks, brokers, custodians, and clearinghouses—have taken a cut from every transaction. Now, digital assets and real world assets (RWA) are cutting out the middlemen, enabling peer-to-peer value exchange with lower costs, faster speeds, and greater transparency.

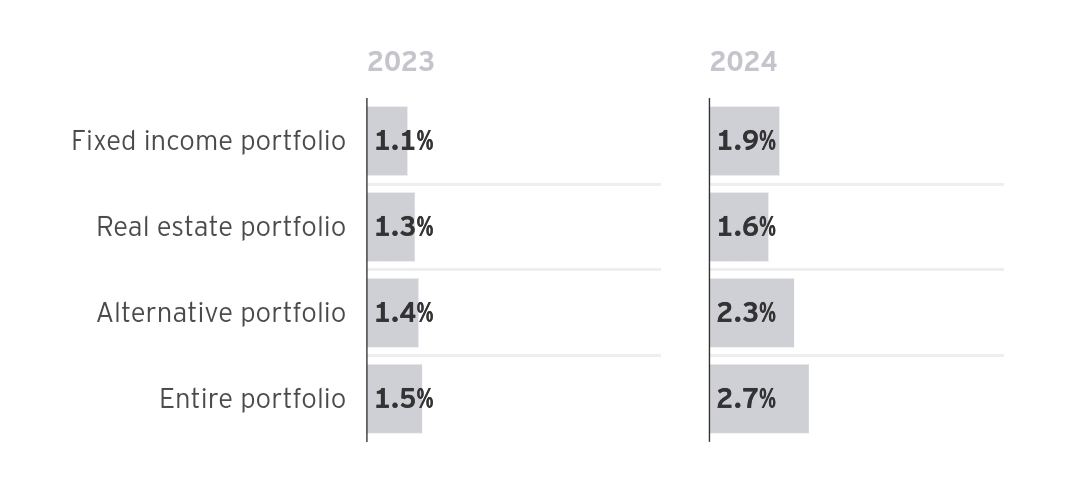

Tokenization Gets a Boost, but Questions Remain

Asset managers and investors are taking a closer look at asset tokenization as regulators indicate they are more open to digital assets. Alongside cryptocurrency, and native digital tokens like Solana, asset tokenization allows for other asset classes like equities or real estate investments to be managed on a blockchain. Advocates of asset tokenization say that by bringing more assets onto the blockchain

© 2026