IT IS YOUR MONEY

Digital Assets and RWA: Transforming the Way Governments Collect Taxes and Manage Public Revenue

Tax collection and public revenue management are critical functions for any government, yet they often suffer from inefficiencies, fraud, and lack of transparency. Digital assets and real world assets (RWA) are offering innovative tools to modernize taxation, improve compliance, and enhance fiscal accountability.

The regulation of the tokenization of real-world assets (RWA) in the Emirati Arabi Uniti (UAE)

The Emirati Arabi Uniti are establishing themselves as one of the main global hubs for the tokenization of real-world assets (RWA). The digitization of tangible assets, such as real estate, through blockchain offers significant advantages, including greater liquidity and access to fractional investments. However, for the sector to grow sustainably, clear regulation is necessary. The real estate sector is one of the most affected by tokenization.

What Are Real World Assets (RWA)?

Real World Assets (RWA) refers to the process of taking tangible assets from the physical world and representing them as digital tokens on a blockchain. Imagine owning a small piece of a high-value office building or earning interest from a U.S. government bond, all through a crypto wallet. This is the promise of RWAs – connecting the digital world of blockchain with tangible, real-world asset value, improving the accessibility of previously exclusive investments.

Digital Assets and RWA: Unlocking New Opportunities in Legal Tech and Intellectual Property

Legal technology and intellectual property (IP) management are undergoing a transformation as digital assets and real world assets (RWA) introduce new ways to register, license, and enforce rights. Blockchain-based solutions are enhancing transparency, automating licensing agreements, and providing immutable records of ownership and usage.

Digital Asset Technologies Celebrates GENIUS Act as Pivotal Moment for U.S.

The GENIUS Act not only positions the United States alongside every other G20 nation that has developed or is piloting programmable money systems — including Europe’s MiCA framework and CBDC programs in China, Japan, and Canada — it actually leapfrogs them. Unlike most of these jurisdictions, which are focused solely on central bank digital currencies (CBDCs), the U.S. is now enabling regulated private enterprises to issue secure, redeemable, and transparent stablecoins

SEC’s June 5 Conference on Digital Assets and Tokenization

The U.S. Securities and Exchange Commission (SEC) is set to host its third annual Conference on Emerging Trends in Asset Management on Thursday, June 5, 2025. The event will focus on digital assets and tokenization, bringing together industry leaders, regulators, and academics to discuss the evolving landscape of asset management. SEC Commissioner Hester M. Peirce will lead the conference, alongside Investment Management Division

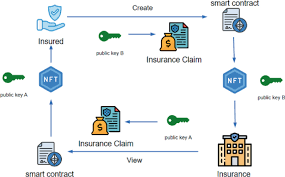

Digital Assets and RWA: Enabling the Next Generation of Insurance Claims Processing

Insurance claims processing has long been plagued by delays, paperwork, and disputes. Digital assets and real world assets (RWA) are addressing these inefficiencies by enabling smart contract-driven claims, parametric insurance models, and transparent dispute resolution mechanisms that enhance speed, accuracy, and customer satisfaction.

WeBank targets RWA tokenization

WeBank Technology Services has unveiled POTOS (Portal of the Orient Symposium for Web3), a new blockchain and real world asset (RWA) tokenization infrastructure targeting Hong Kong’s Web3 ecosystem. In its initial phase, POTOS provides a three layer ‘value exchange’ infrastructure solution for institutions: a high performance blockchain to connect different asset types, cross chain protocols enabling atomic swaps, and advanced security technologies including zero knowledge proofs.

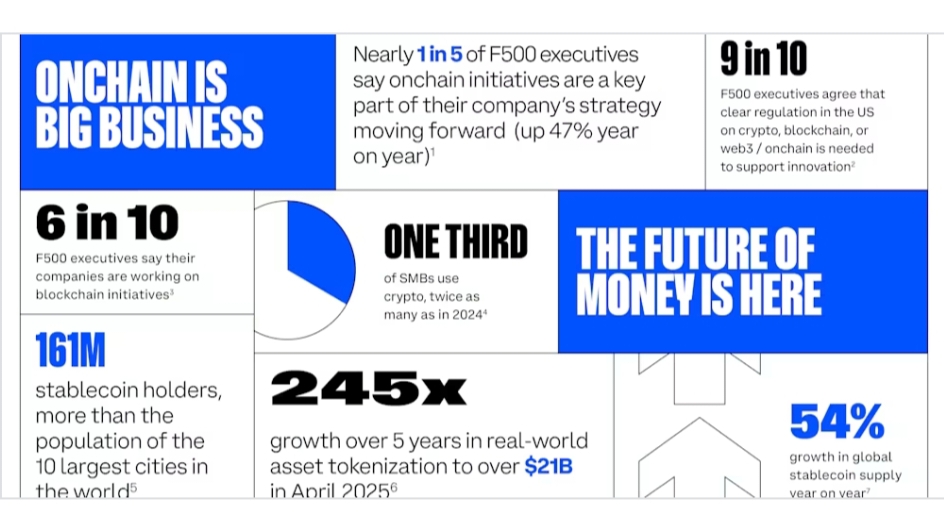

The Future of Money Is Here

2025 has marked crypto’s turning point, driven by the surge of digital asset adoption, real-world tokenization, and growing institutional and small business engagement. At the center of it all, stablecoins have emerged as the dominant force powering onchain utility and real-time, global payments. According to new research conducted for Coinbase by The Block Pro Research, organic stablecoin transfer volume has reached unprecedented levels

Digital Assets and RWA: The Future of Maritime Trade and Shipping Finance

Shipping is the backbone of global trade, yet its financial infrastructure remains outdated and opaque. Digital assets and real world assets (RWA) are introducing transformative solutions by enabling tokenized vessel ownership, automated cargo financing, and decentralized trade settlements that improve efficiency across maritime logistics.

GENIUS Act puts renewed spotlight on stablecoins, digital assets

The Senate lawmakers who passed the “Guiding and Establishing National Innovation for U.S. Stablecoins,” or GENIUS Act, on Tuesday aim to create a regulatory framework for the issuance of stablecoins — a step that could enable finance leaders to consider more use cases for the crypto asset.\\r\\n\\r\\nThe regulatory clarity the GENIUS Act, which has yet to pass the House, seeks to create in the cryptocurrency space will be a key factor in opening the door

Why Every Bank Needs a Digital Asset Strategy

Nathan McCauley leads the only federally chartered digital asset bank—Anchorage Digital—and partners with other banks looking to crack into crypto. With regulatory progress and market momentum driving more institutions into the digital-asset ecosystem, McCauley unpacks why banks of all sizes need to develop comprehensive crypto strategies today to remain competitive as the crypto industry swiftly evolves. Drawing on insights from the latest in blockchain innovation—including tokenization

Digital Assets and RWA: Revolutionizing the Way We Invest in Aviation

The aviation industry is capital-intensive, with high barriers to entry for private investors. Digital assets and real world assets (RWA) are changing this dynamic by enabling fractional ownership of aircraft, transparent asset tracking, and new financing models that make aviation investments more accessible and efficient.

Who’s responsible for unclaimed digital assets?

That is the question that the state Assembly overwhelmingly sought to clear up in a recent vote, agreeing to expand California’s unclaimed property law to include digital assets, such as Bitcoin, cryptocurrency or other virtual currency used in private transactions. Existing law related to unclaimed property doesn’t explicitly include digital assets, according to the fact sheet for AB 1052. But the bill from Assemblymember Avelino Valencia, D-Anaheim, would move digital assets

Malaysia launches Digital Asset Hub to test stablecoin, programmable money

Prime Minister Anwar Ibrahim announced the initiative during the Sasana Symposium 2025 in Kuala Lumpur, according to a report by The Business Times. He described the hub as the “beginning of a new chapter” for Malaysia’s digital economy. Ibrahim said the sandbox will allow use cases such as programmable payments, ringgit-backed stablecoins and supply chain financing to be explored in a controlled environment.

Digital Assets and RWA: A New Era for Philanthropy and Impact Investing

Philanthropy and impact investing are undergoing a transformation as digital assets and real world assets (RWA) introduce new mechanisms for transparent giving, measurable outcomes, and decentralized governance. Blockchain technology enables donors, foundations, and social enterprises to deploy capital more efficiently while ensuring accountability and traceability across charitable initiatives.

Vietnam Passes Landmark Law Defining Digital Assets

Vietnam's National Assembly overwhelmingly approved landmark legislation Saturday, legalizing digital assets and establishing sweeping incentives for semiconductor manufacturing, artificial intelligence development, and digital technology startups. The Law on Digital Technology Industry passed with 441 votes in favor out of 445 lawmakers present, making Vietnam one of the first countries to comprehensively regulate digital assets

Pakistan aspires to lead Global South in adoption of digital assets

In a bold demonstration of Pakistan's commitment to digital assets and economic innovation, Minister for Finance and Revenue Senator Muhammad Aurangzeb chaired a high-level meeting. The meeting was attended by Minister of State for Crypto and Blockchain Bilal Bin Saqib and Michael Saylor, Executive Chairman of Strategy (formerly MicroStrategy) - the world's largest corporate holder of Bitcoin, said a press release issued by the Ministry of Finance on Sunday.

Transforming the Music Industry’s Financial Model by adopting Digital Assets and RWA

The music industry is embracing digital innovation as artists, labels, and investors leverage digital assets and real world assets (RWA) to unlock new revenue streams, improve royalty distribution, and engage fans through novel ownership models. Blockchain technology is enabling musicians to tokenize their intellectual property, create direct fan relationships, and access global capital markets.

Digital Assets Banking Group Sygnum to Expand Global Operations

In January, Sygnum completed its “oversubscribed USD 58m multi-stage Strategic Growth Round and, with its new 1 billion valuation, achieved Unicorn status. 2024 accelerating business momentum and group operational profitability was driven by core business growth across its European, Asian and Middle East hubs, as well as by Sygnum Protect, the group’s off-exchange custody platform launched with Binance.” Last year, Sygnum’s gross revenues “increased by 40%, annual trades surged by over 1000%

© 2026