IT IS YOUR MONEY

Fractional Aircraft Ownership via Tokens

Fractional aircraft ownership is being transformed by tokenization, allowing investors to own shares in private jets through blockchain-based digital tokens. This model reduces costs, increases utilization, and enables transparent revenue sharing from charter flights. Companies like JetSmarter and FlyExclusive are exploring on-chain models. This innovation makes private aviation accessible beyond the ultra-wealthy.

Democratizing Access to Private Aviation

Private jet ownership has long been a symbol of elite status, with prices ranging from $3 million for a light jet to over $70 million for a Gulfstream G700. High maintenance, crew, and storage costs make full ownership impractical for most.

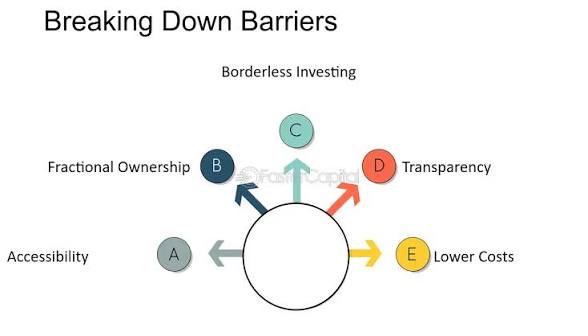

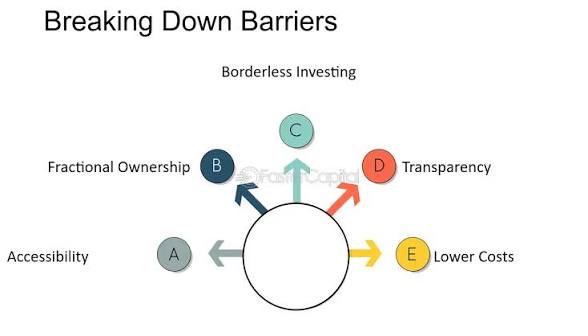

Fractional ownership programs—pioneered by NetJets—allow buyers to purchase a share (e.g., 1/16th) of a jet, granting a set number of annual flight hours. However, these programs require minimum investments of $300,000+ and lack secondary market liquidity.

Tokenization disrupts this model by dividing ownership into thousands of blockchain-based tokens, each representing equity in a legally structured aircraft SPV.

How Tokenized Jets Work

An aircraft is acquired and placed into a special-purpose vehicle (SPV) registered in a favorable jurisdiction (e.g., Bermuda or Ireland). It undergoes valuation, insurance, and legal structuring.

Ownership shares are issued as security tokens on a compliant blockchain. For example, a $15 million Falcon 7X could be tokenized into 1.5 million tokens at $10 each. Accredited investors purchase tokens via regulated platforms.

Revenue streams include:

Charter flight income (when the jet is not in use by owners)

Appreciation upon resale

Tax depreciation benefits (in certain jurisdictions)

Smart contracts automate monthly distributions of net profits in stablecoins.

Real-World Pilots and Industry Interest

In 2023, JetVault, a Dubai-based fintech, tokenized a Bombardier Challenger 650, raising $12 million from 450 global investors. Token holders receive quarterly payouts from charter operations and voting rights on fleet upgrades.

FlyExclusive partnered with a blockchain platform to pilot tokenized shares in its fleet, aiming to improve capital efficiency and member engagement.

Luxury investment platforms like YieldX and RealtyMogul are exploring aviation-linked tokens as part of diversified alternative asset portfolios.

Even traditional fractional providers are evaluating tokenization to enhance liquidity and attract younger, tech-savvy investors.

Benefits: Cost Efficiency, Utilization, and Transparency

Tokenization reduces entry costs from hundreds of thousands to just a few hundred dollars. It also improves aircraft utilization—idle time is monetized through charter bookings, increasing returns.

Ownership history, maintenance logs, and flight revenue are recorded on-chain, ensuring transparency.

Secondary markets allow investors to trade tokens, providing liquidity absent in traditional fractional models.

For operators, tokenization offers faster fundraising and broader investor bases without diluting control.

Challenges and Regulatory Path Forward

Aviation is highly regulated. Tokenized ownership must comply with FAA (U.S.), EASA (EU), and local airworthiness rules. Jurisdictional alignment is critical.

Insurance, liability, and operational management remain complex. Reputable platforms partner with certified operators and insurers like AIG to mitigate risk.

As digital securities frameworks mature, tokenized aviation will gain legitimacy.

Private jet ownership is no longer reserved for billionaires. By unlocking fractional access through blockchain, this innovation is making premium mobility a scalable, income-generating asset class.

To learn how tokenized aircraft can diversify your portfolio with high-value, yield-producing assets, visit DigitalAssets.Foundation and consult with specialists. FREE consultation.

More News

© 2026