IT IS YOUR MONEY

Tokenized Equity: Shares Without Intermediaries

Tokenized equity is redefining company ownership by issuing shares as digital tokens on blockchain, eliminating layers of intermediaries like transfer agents and clearinghouses. Startups and private firms use this model for faster cap table management and global investor access. Platforms like Tokeny and Polymath enable compliant issuance, signaling a shift in how equity is issued and managed.

From Paper Certificates to Digital Shares

Traditional equity—whether in public or private companies—is managed through paper certificates, centralized registries, and third-party administrators. This system is slow, costly, and prone to errors in cap table management, especially during funding rounds or exits.

Tokenized equity replaces this with blockchain-based digital shares. Each token represents a unit of ownership, encoded with compliance rules (e.g., transfer restrictions, shareholder rights) and stored in a digital wallet.

Smart contracts automate issuance, dividend distribution, voting, and secondary transfers—reducing settlement from days to seconds.

How Tokenization Enhances Corporate Governance

For private companies, tokenized equity simplifies cap table management. Instead of spreadsheets and legal filings, ownership is recorded immutably on-chain, with real-time visibility for founders and investors.

During a funding round, new shares can be issued instantly to multiple investors across jurisdictions. Smart contracts enforce investor accreditation, lock-up periods, and anti-dilution clauses—ensuring compliance by design.

At exit events (acquisition or IPO), proceeds are automatically distributed based on token holdings, eliminating reconciliation delays.

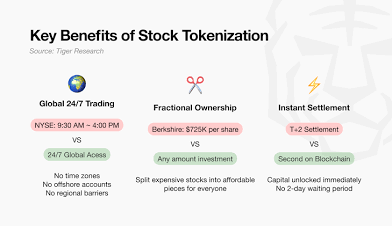

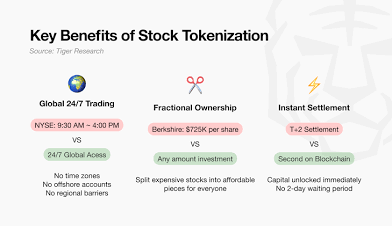

For public companies, tokenized shares could enable 24/7 trading, instant settlement (T+0), and direct shareholder engagement via on-chain voting.

Real-World Use Cases and Platform Adoption

In 2023, Neufund, a European equity tokenization platform, helped a German biotech firm raise €8 million from 1,200 investors via tokenized shares. All compliance was embedded in the smart contract, and tokens are tradeable on a licensed digital exchange.

Tokeny, backed by Société Générale, has issued over €2 billion in tokenized securities, including private equity and corporate bonds. Its platform supports investor whitelisting, AML checks, and cross-border transfers.

In the U.S., Polymath enables compliant STO (Security Token Offering) launches, with clients in real estate, fintech, and renewable energy.

Even public firms are exploring the model. Overstock.com (now Bed Bath & Beyond) issued tZERO shares as security tokens, demonstrating the viability of digital equity at scale.

Benefits: Speed, Transparency, and Global Access

Tokenized equity reduces administrative costs by up to 70%, according to PwC. It enables borderless fundraising—investors from Asia, Europe, or Latin America can participate seamlessly.

Transparency improves trust. Shareholders can verify ownership, voting records, and financial disclosures on-chain.

Additionally, secondary liquidity increases. Tokens can be traded on regulated ATS platforms, giving early investors earlier exit options.

Challenges and Regulatory Outlook

Legal recognition of digital shares varies. In the U.S., the SEC treats them as securities, requiring compliance with Regulation D, S, or A+. The EU’s MiCA framework includes provisions for digital securities, offering clearer pathways.

Custody and interoperability remain challenges. However, institutional-grade wallets and regulated exchanges are maturing rapidly.

Tokenized equity is not replacing traditional shares—it’s modernizing them. As infrastructure evolves, digital ownership will become the standard for efficient, transparent corporate finance.

To explore how tokenized equity can streamline your company’s capital structure or investment process, visit DigitalAssets.foundation and receive a FREE consultation.

More News

© 2026