IT IS YOUR MONEY

DELTHY Restaurants' accepting DBVs: Tokenizing Customers LOYALTY. Thus, you *Eat Yourself Rich!

DELTHY Restaurants brilliantly leverages the DigitalBenefits.Network its DBV infrastructure to create an engaging, gamified customer experience, which is built on a dual-engine model. DELTHY is pioneering this by making every meal an entry into a wealth-creation game and a step into the digital asset economy, setting a new standard for the restaurant industry and retail at large. Tokenizing Customers LOYALTY. Thus you *Eat Yourself Rich!

Leading Force in China Serving 300,000+ Casual Catering Businesses, to Launch Tokenized Smart Supply

According to the agreement, Reitar and Xianmu will set up a joint venture for Hong Kong and overseas markets. By combining Reitar’s global logistics ecosystem platform, smart cold chain facilities and blockchain RWA (Real World Asset) tokenization with Xianmu’s advanced digital procurement platform and supply chain management

Switch Reward Card Aims to Transform Consumer Finance with Crypto-Integrated Debit and Rewards

A New Twist on Spending and Earning Switch Reward Card presents itself not just as a debit card, but as part of a broader financial ecosystem that blends digital currency trading, rewards, and decentralized finance technologies. Users can manage funds in a mix of fiat and cryptocurrency — including holdings like Bitcoin and Ethereum — and transact globally with a single card or digital wallet.

Capture Carbon International: Green Fenix Trees are growing Digital Money While Healing the Planet.

As the global carbon credit market surges toward a projected $6 trillion by 2035. CCI is tokenizing verified carbon removals credits using blockchain, participating in the Real World Assets Tokenization industry and using “Digital Money” (DM) as unit of account to back CCI's carbon credit ecological value. This isn’t just reforestation—it’s regenerative finance by a Unique Tree.

Pioneering a sustainable future: Carbon credit tokenisation.

Understanding carbon credits: Carbon credits, also known as carbon offsets, are permits that allow the owner to emit a certain amount of carbon dioxide or other greenhouse gases. The direct relationship between sustainability and human prosperity prompts us to reimagine possibilities to integrate sustainable considerations, preferences, and practices in our day-to-day life. This illustrates the projected increase in demand for carbon credits over the coming decades

England enacts law recognizing digital assets as property

The Property (Digital Assets, etc) Act 2025 has received Royal Assent, creating a new category of property under English law. Digital assets such as cryptocurrency did not fit neatly into existing laws, resulting in the courts creating a new category, which is now recognized in the legislation. If an asset is not recognized as property, it becomes tricky to recover the asset if it’s stolen or enforce ownership rights. However, based on previous work from the Law Commission

Beyond Points: DigitalBenefits.Network a Blockchain Powering the Tokenized Customer Loyalty industry

ENTER A NEW PARADIGM: DigitalBenefits.Network. This isn't just another points program; it's a global, blockchain-based ecosystem that revolutionizes how value is earned, exchanged, and redeemed. By digitizing benefits into flexible, tradeable assets, it forges deeper, more profitable customer relationships while offering businesses an unprecedented 90% reduction in operational overhead. The era of static loyalty is over.

How some Chinese exporters benefit from US dollar-backed stablecoins

In this explainer, the Post outlines four roles that US dollar-backed stablecoins play in China’s overseas trade, based on a recent analysis by Zou Chuanwei, the president of the Jiangsu Jinke Research Institute on Digital and Technology Finance, published in Tsinghua Financial Review. How are Chinese traders using US dollar-backed stablecoins? First, some overseas importers face regulatory barriers that restrict them from using traditional US dollars.

Digital asset bank in Norfolk to mark new chapter for finance in the state.

Nebraska made national history last week when Gov. Jim Pillen formally signed a charter for Telcoin Digital Asset Bank in Norfolk — making it the first state in the country to authorize a digital bank with the ability to mint stablecoins.\r\n\r\nThe move is not only a milestone for the rapidly evolving world of digital finance, but also a major economic moment for both Nebraska and the Norfolk community.\r\n\r\n“We’re the first digital asset depositary institution in the state of Nebraska

Asset Tokenization: Redefining Liquidity in Private Markets

Private equity, venture capital, and pre-IPO shares have long suffered from illiquidity and limited access. Tokenization is transforming these markets by enabling fractional ownership and secondary trading—bringing unprecedented liquidity and transparency to once-closed investment arenas.

The best way to regulate digital assets: Merge the SEC and CFTC

Now that President Trump has signed into law the GENIUS Act to regulate stablecoins—a crypto tokens whose value is pegged to the dollar—Congress is taking up crypto “market structure” legislation to regulate the issuance and trading of digital assets.1 Although the current proposals have some good features, they could do more harm than good. Instead, we should consider a different path—merging the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

Chainlink establishes itself as the undeniable leader in real-world asset (RWA) tokenization

Chainlink has established itself as the reference oracle network for real-world asset tokenization. Its technology enables smart contracts to securely access real-world data, an essential condition for creating reliable tokenized assets. Nazarov explained that the company acts as an intermediary for transactions between financial institutions, asset issuers, and regulators, positioning Chainlink as the essential bridge between traditional finance and DeFi.

RWA Meets DeFi: Bridging Traditional Finance with Innovation

The convergence of Real World Assets and Decentralized Finance is unlocking new economic models. By integrating tokenized RWAs into DeFi protocols, users gain access to real-yield opportunities, improved collateral options, and hybrid financial services that merge regulatory compliance with open-access innovation.

Kraken, Backed expand tokenized stocks to Tron ecosystem amid RWA push

On Wednesday, cryptocurrency exchange Kraken and tokenization platform Backed Finance announced an expansion of xStocks, a tokenized stock product offering, to the Tron blockchain. The move comes as real-world asset (RWA) tokenization, particularly within stocks, is taking hold. According to the announcement, Backed will deploy the stocks as TRC-20 tokens. Previously, Kraken and Backed launched xStocks on Solana and BNB Chain.

Tokenized US Treasuries reach $7.45 billion all-time high

US tokenized treasury products reached a new all-time high of $7.45 billion on Aug. 27, surpassing the previous peak of $7.42 billion registered on July 15. According to rwa.xyz data, the milestone caps a 14% recovery over two weeks following a market correction that bottomed out at $6.51 billion on Aug. 13. The tokenized treasury sector experienced a 12% decline from its mid-July peak. BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) maintains market leadership

Tokenized Treasuries: Safe-Haven Digital Assets Gain Traction

Investors are increasingly turning to tokenized U.S. Treasuries as a secure entry point into digital assets. Backed by government debt and offering near-instant settlement, these RWA tokens combine the safety of traditional bonds with blockchain efficiency—delivering yield, transparency, and global access in a rapidly evolving financial landscape.

Tokenization fuels LATAM; RWA protocol breach reached $14.6M

The inaugural Bitfinex Securities Market Inclusion Report noted that tokenization of financial instruments using blockchain technology offers a rare socio-economic opportunity for the emerging region. The report hinged its findings on the responses of LATAM experts and financial sector players from eight nations, including Brazil, Argentina, Chile, Colombia, Panama, and Peru.

From Bonds to Buildings: RWA Tokenization Reshapes Finance

Real-world assets—from government bonds to commercial buildings—are being reimagined through tokenization. This evolution enhances efficiency, transparency, and accessibility across financial markets. As legacy systems struggle with delays and opacity, RWA-powered digital assets offer a faster, more equitable alternative poised to redefine global finance.

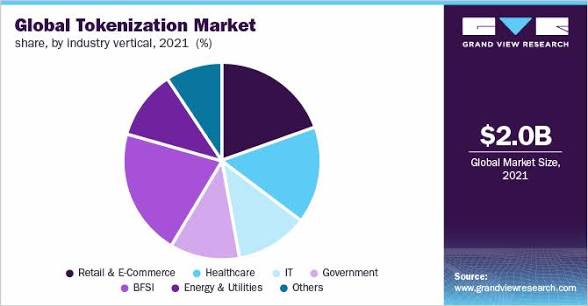

RWA Tokenization Market To Reach $16T by 2030, Skynet Report Says

Institutional Interest in Tokenization The report noted that traditional financial institutions and blockchain-native firms are driving adoption, using RWA products for both yield opportunities and liquidity management. Skynet said major banks and asset managers are exploring tokenization as a way to digitize assets ranging from debt instruments to commodities. The report pointed to growing use cases in private credit, trade finance, and money market funds.

RWA tokenization explodes 70% YTD, eyes $400 trillion

RWA tokenization surges to an all-time high! Researchers Andrew Ho and Ming Ruan from Animoca Brands believe that as the tokenized RWA market develops, it has the potential to encompass trillions of dollars of traditional financial assets across multiple blockchain networks. However, despite the tokenized RWA market climbing to $26.5 billion, it still represents only a tiny portion of the $400 trillion total addressable market.

© 2026