IT IS YOUR MONEY

Digital Assets and RWA: Enabling the Next Generation of Insurance Claims Processing

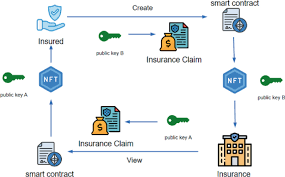

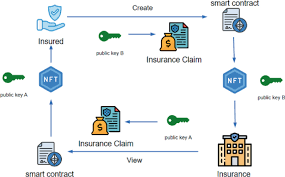

Insurance claims processing has long been plagued by delays, paperwork, and disputes. Digital assets and real world assets (RWA) are addressing these inefficiencies by enabling smart contract-driven claims, parametric insurance models, and transparent dispute resolution mechanisms that enhance speed, accuracy, and customer satisfaction.

Automating Claims with Parametric Insurance

Parametric insurance pays out based on predefined conditions—such as weather events or flight delays—rather than requiring manual damage assessments. Digital assets and RWA facilitate these payouts through smart contracts, ensuring instant execution once triggers are met.

Real-Time Data Integration for Faster Settlements

IoT sensors, satellite imagery, and blockchain analytics are being used to verify incidents in real time. For example, if a flood sensor detects water levels exceeding a threshold, homeowners receive automatic compensation without needing to file a claim.

Transparent Dispute Resolution via On-Chain Records

All insurance transactions involving digital assets and RWA are recorded immutably on the blockchain. This provides a clear audit trail that both policyholders and insurers can reference in case of disputes, reducing litigation costs and increasing trust.

Fractional Risk Pooling and Peer-to-Peer Coverage

Decentralized insurance models allow individuals to pool resources and insure each other against specific risks. Digital assets and RWA enable secure, transparent participation in these peer-to-peer networks, offering flexible coverage options outside traditional insurance frameworks.

To discover how digital assets and RWA are transforming insurance operations and customer experience, visit DigitalAssets.Foundation for expert analysis and a FREE consultation.

More News

© 2026